Bank of America Corp (NYSE:BAC) stock is trading flat this afternoon, last seen at $28.40. Amid today's focus on big banking earnings, traders are more than likely gearing up for Bank of America's upcoming third-quarter earnings report, which is slated to hit the Street before the market opens on Monday, Oct. 15. Below we will take a look at how BAC has been faring on the charts, as well as what the options market is pricing in for the shares' post-earnings moves.

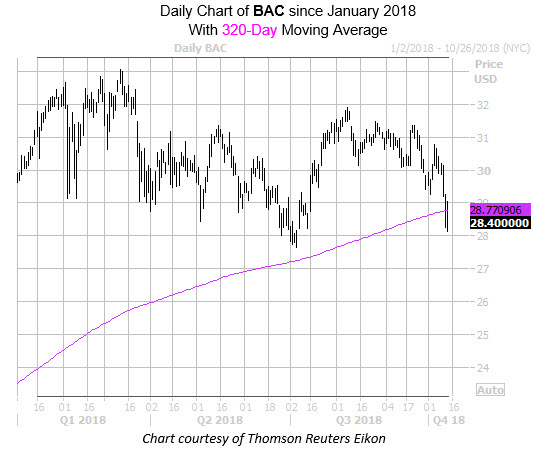

BAC has dropped nearly 7% in the past week -- set for its worst stretch since March -- and is now trading south of its 320-day moving average for the first time since the 2016 presidential election. In addition, Bank of America stock is back below its year-to-date breakeven level of $29.52. The $29-$30 area has acted as a floor for the security for most of 2018, with the $32-$33 area emerging as a ceiling.

Looking at its earnings history, BAC closed higher the day after reporting in five of the last eight quarters, including the past two in a row. After earnings in July, the shares gained 4.3% in the subsequent session. Looking broader, the shares have averaged a slim 1% move the day after earnings over the last two years, regardless of direction. This time around, however, BAC options are pricing in quadruple that, expecting a 4% swing for Monday's trading.

As far as direction, it appears option buyers are expecting a positive earnings reaction, as BAC calls have been flying off the shelves of late. This is per data from the (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows the banking firm's 10-day call/put volume ratio of 6.16, ranking in the 88th percentile of its annual range.

During this time frame, the expiring weekly 10/12 29.50-strike call saw the largest increase in open interest, with an addition of more than 83,000 contracts. Meanwhile, the October 30.50 call -- which encompasses next week's earnings release -- has seen nearly 75,000 contracts opened, most of which were purchased.

Today, BofA calls are trading at twice the average intraday pace, with nearly 400,000 exchanged so far. Most active is the October 30 call, where more than 100,000 contracts have crossed the tape.

Echoing this is the stock's Schaeffer's put/call open interest ratio (SOIR) of 0.48, which ranks just 1 percentage point from an annual low. In other words, short-term speculators are more call-heavy than usual toward BAC stock.

Likewise, analyst sentiment remains optimistic toward the financial giant. Overall, nine of the 16 covering brokerage firms sport "buy" or "strong buy" recommendations. Plus, Bank of America stock's average 12-month price target of $34.89 comes in at a substantial 24% premium to current trading levels.