We last wrote about Bank of America (NYSE:BAC) in January, shortly after the company’s Q4 2018 report. The market was in a positive mood, sending the share price up to $28.44 at the time of writing. In addition, our Elliott Wave analysis of the situation indicated more strength can be expected going forward.

Nine months later now, BAC is hovering around $31, up 9% since our last update. This is not at all a bad result, but we admit we thought the bulls could achieve it much faster. What took them so long and do they still have the upper hand?

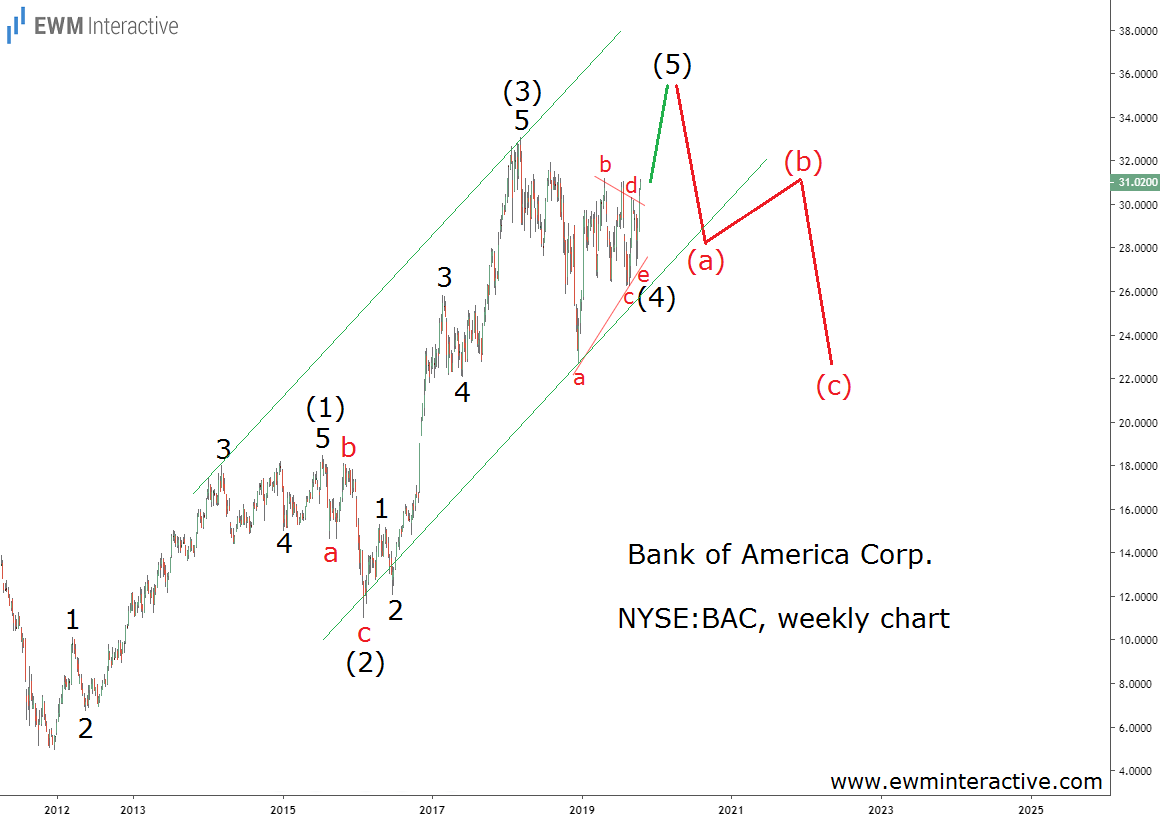

The updated weekly chart above sheds some light on the subject. It looks like the reason for the bulls’ slow progress in 2019 was wave (4)’s choice to develop as a triangle correction. Triangles are corrective patterns which consists of five sub-waves and therefore take more time than a simple a-b-c zigzag retracement, for example.

This count suggests that wave (5) has just begun from the bottom of wave “e” of (4) at $27.16. According to the theory, triangles precede the final wave of the larger pattern. Here, the triangle fits perfectly into the larger impulse which has been in progress since the bottom at $4.92 in December 2011.

If this count is correct, wave (5) is going to lift Bank of America stock to $35 – $36 a share, implying 13-16% upside from the current level. Then, a three-wave correction back to the support of wave (4) near $22 should be expected.