Earnings season is upon us and with the rising market, earnings expectations have followed.

This is especially true for the banking sector which is supposed to have well outperformed the first quarter.

The reason for such predictions can be attributed to bank's increased profits from low-interest rates enticing a wave of new mortgages and loans throughout the pandemic.

With that said, which banks have the best technical chart setups to trade from a daily perspective?

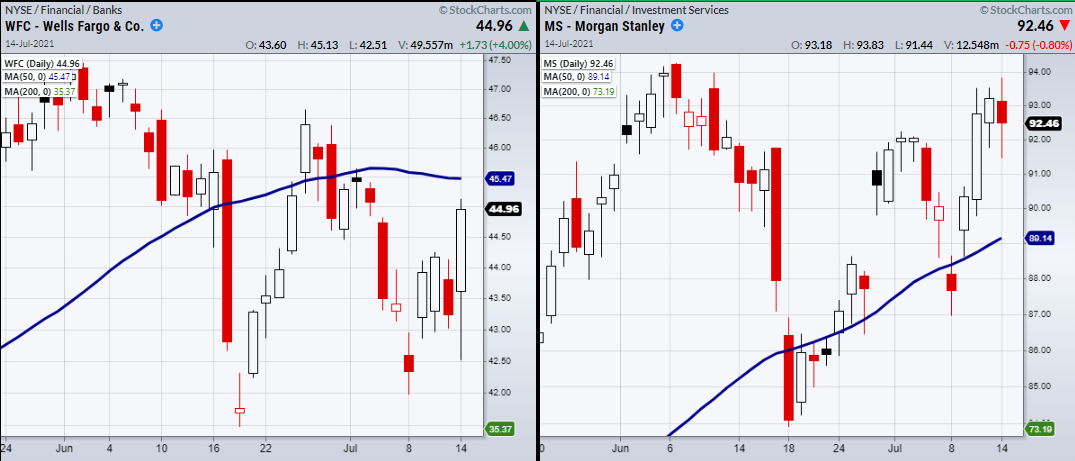

Wells Fargo (NYSE:WFC) reported on the 14 and took off towards its 50-Day moving average at $45.46.

With such a large move, it will need to clear its major moving average as the 50-DMA represents nearby resistance to clear.

On the other hand, Morgan Stanley (NYSE:MS) is in a strong bullish phase and could be traded on a break to new highs.

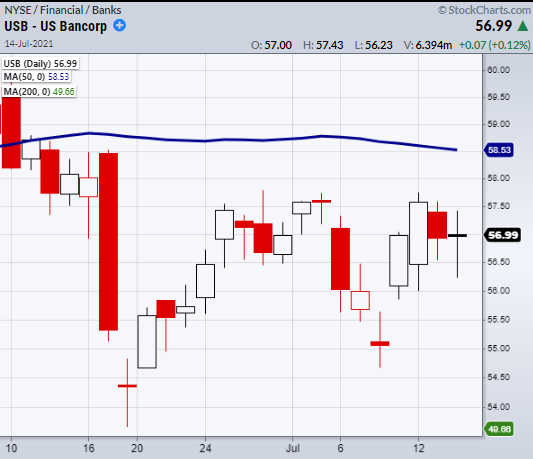

Another bank that looks interesting is U.S. Bancorp (NYSE:USB).

However, like WFC, USB also needs to confirm a phase change over its 50-DMA at $58.53.

Note that both USB and MS report earnings pre-market on July 15..

Our stance on taking new trades in earning season is normally to wait for the company to report before taking a trade.

That makes this week a potential great opportunity to buy bank stocks as earnings is out of the way, and as laggards, should the market hold, have lots of upside potential.

ETF Summary

S&P 500 (SPY) 427 support area.

Russell 2000 (IWM) Watching support at 217.85.

Dow (DIA) 351.09 high to clear.

NASDAQ (QQQ) 359.65 minor support the 10-DMA.

KRE (Regional Banks) Lots of bank earnings tomorrow could push KRE higher. Next support area at 61.24.

SMH (Semiconductors) Cleared highs but could not hold. 10-DMA at 258.50.

IYT (Transportation) 251.78 support.

IBB (Biotechnology) Like to see 158.60 level hold.

XRT (Retail) 99.24 main resistance. 91.71 main support.

Junk Bonds (JNK) 109.57 support needs to hold.

XLU (Utilities) tested the 50-DMA at 65.07 and failed.

SLV (Silver) Like to see this hold over the 10-DMA at 24.22.

VBK (Small Cap Growth ETF) 279.34 the 50-DMA.

TLT (iShares 20+ Year Treasuries) Inside day.

USD (Dollar) 91.40 support area. 93.44 resistance.

DBA (Agriculture) 17.54 support. Siting in resistance around 18.02 -18.46.

GLD (Gold Trust) Watching to clear 50-DMA at 171.82.

TAN (Solar Energy) 80.26 next main support area.

USO (US Oil Fund) 48.22 recent support.

XME (S&P Metals and Mining) 44.42 resistance level.