Investing.com’s stocks of the week

If the markets were the patron of a restaurant and had just ordered a bottle of Spanish rioja (Campo de Bailout), they would be sending it back at the moment. The rally that everyone envisaged would come as a result of the proposed EUR100bn for the Spanish banking sector disappeared into thin air yesterday afternoon as investors worried about the structure of the debts and their seniority over others. It therefore seems that EUR100bn now buys you about 6hrs of peace and quiet in these markets.

The impact on Spanish fiscal security was also highlighted as an issue with Spanish yields actually finishing higher on the day. The ratings agency Fitch also acted yesterday by downgrading Spain’s 2 largest banks, BBVA and Santander, on the basis of the Spanish downgrade last week.

All in all, it was a day to forget for the periphery as Italy, who have been happily sat on the side-lines now for a couple of weeks, were dragged kicking and screaming back into the limelight as speculation increased that their banking sector too would need a similar bailout. Their 10 year bond yield is now back above the 6% level for the first time since January. Italy wasn’t helped by confirmation yesterday that their economy shrank by 0.8% in Q1 with exports shrinking for the second consecutive month.

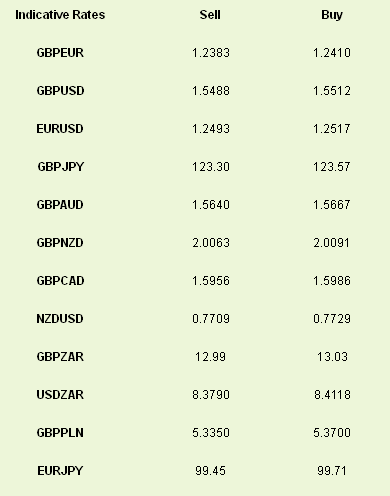

The euro which had been on a royal tear higher sharply reversed with GBPEUR back towards the 1.24 level after looking like the 1.22s were on the cards earlier in the day. GBPUSD slipped however as the euphoria drained away and investors once again got long of havens.

Focus now shifts away from Spain and back towards Greece and the elections due this weekend. Polling data is unavailable in the fortnight before the elections so we have little idea as to the voting intentions of the Greek public but we would submit that campaigns and recent articles from Greece suggest that the result will be similar to the last election. The risk to this is that the Greek electorate have finally become disillusioned with the extremist crackpots that have come out of the woodwork in the past few months and return to the bosom of PASOK or New Democracy for safety’s sake. This would be a net positive and would be the catalyst for a euro rally in the short term.

UK industrial production is the most important data release today, coming through at 09.30. The release is volatile and the market will be hoping that the disconnect between surveys and official data continues given the last abysmal manufacturing PMI number seen two Fridays ago. Consensus is -0.1%.

Latest exchange rates at time of writing