As I wrote earlier, Thursday was completely bizarre for me, because soaring bonds and weakening interest rates really put the chill on my day (until the end, when it all worked out). Even though, as of this moment, the ES is green (OK, just barely) and the NQ has done about a 100 point about-face from the downside, I’m just as excited about today as I was yesterday at this time, simply because my positions are so interest-dependent. It seems to me bonds are offering great respect to that trendline I’ve drawn, having bounced off it twice.

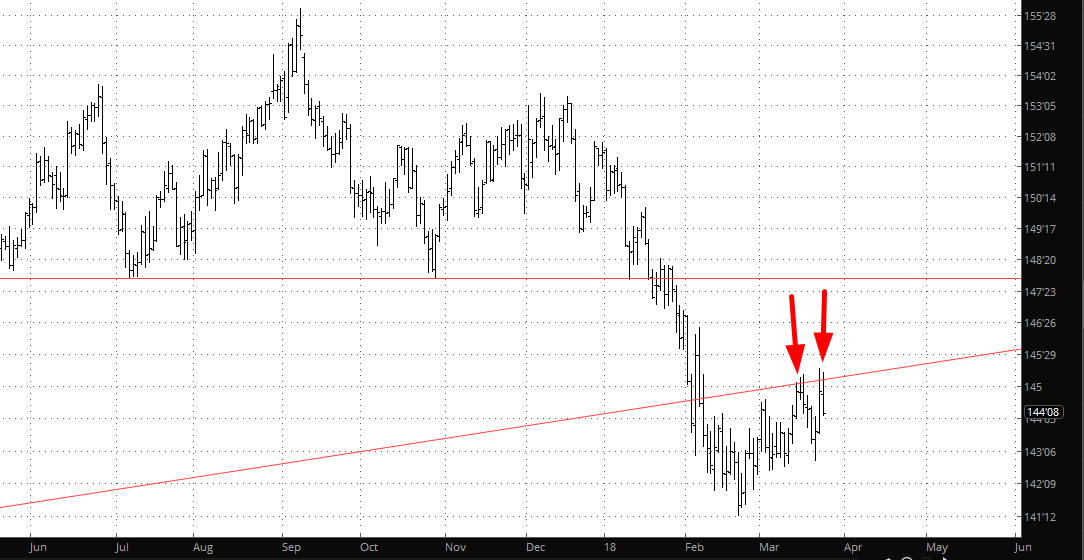

Looking at the bigger picture of /ZB, I show here how on the one hand you’ve got a small bullish formation which is being hemmed in by the trendline, while at the same time there is a humongoid bearish formation above it, compelling prices much lower. It’s a dirty fight at the moment, and it’s unclear who is going to win. My money is on “down”.

I don’t even have a position in bonds, so you may be wondering what the obsession is all about. Well, I’ve got a huge short position in Utilities XLU as well as a heavy concentration in Real Estate shorts. Thus, I’m just as interested in what bonds are doing these days as I am in ES and NQ.