Equities research analysts at Societe Generale started coverage on shares of Banco Santander (NYSE:SAN) in a research note issued to investors on Thursday, MarketBeat.com reports. The brokerage set a "buy" rating on the stock.

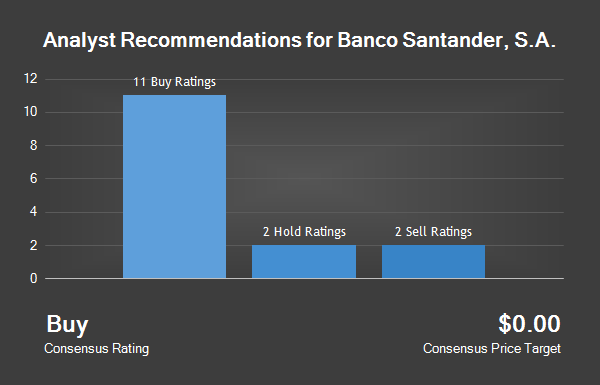

Several other research analysts have also recently weighed in on the stock. Goldman Sachs restated a "buy" rating on shares of Banco Santander, in a research report on Tuesday, December 6th. Banco Santander upgraded shares of Banco Santander, from a "neutral" rating to a "buy" rating in a research report on Wednesday, February 1st. JP Morgan Chase & Co restated a "buy" rating on shares of Banco Santander, in a research report on Thursday, January 5th. Zacks Investment Research cut shares of Banco Santander, from a "buy" rating to a "sell" rating in a research report on Thursday, October 27th.

Finally, BNP Paribas cut shares of Banco Santander, from an "outperform" rating to an "underperform" rating in a research report on Thursday, February 9th. Two investment analysts have rated the stock with a sell rating, three have assigned a hold rating and eleven have assigned a buy rating to the stock. The stock currently has a consensus rating of "Buy" and an average price target of $5.75.

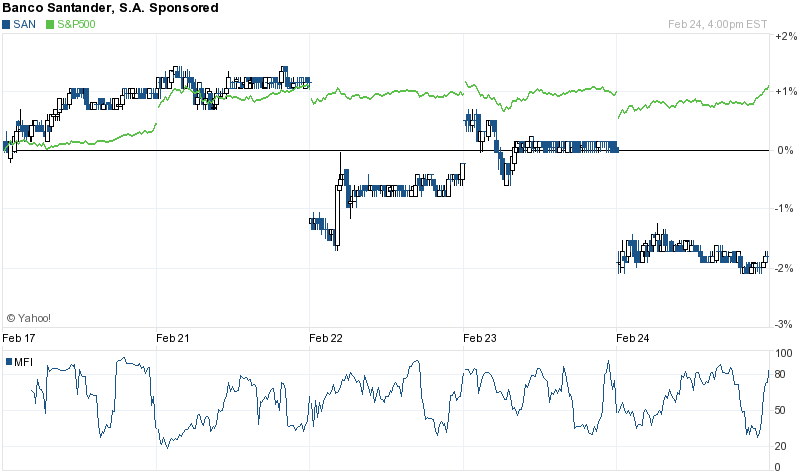

Shares of Banco Santander traded up 0.19% on Thursday, hitting $5.40. 4,924,255 shares of the stock were exchanged. Banco Santander, has a 52-week low of $3.60 and a 52-week high of $5.74. The company has a 50 day moving average of $5.47 and a 200 day moving average of $4.82. The company has a market cap of $93.70 billion, a price-to-earnings ratio of 12.33 and a beta of 1.67.

The firm also recently declared a quarterly dividend, which was paid on Wednesday, February 8th. Shareholders of record on Friday, January 27th were given a dividend of $0.0585 per share. This is a boost from Banco Santander,'s previous quarterly dividend of $0.06. This represents a $0.23 dividend on an annualized basis and a yield of 4.34%. The ex-dividend date was Wednesday, January 25th. Banco Santander's dividend payout ratio (DPR) is presently 38.64%.

A number of hedge funds and other institutional investors have recently modified their holdings of SAN. World Asset Management Inc boosted its position in shares of Banco Santander, by 8.3% in the second quarter. World Asset Management Inc now owns 893,431 shares of the company's stock worth $3,502,000 after buying an additional 68,559 shares during the last quarter. Dimensional Fund Advisors LP boosted its position in shares of Banco Santander, by 0.6% in the second quarter. Dimensional Fund Advisors LP now owns 4,983,295 shares of the company's stock worth $19,535,000 after buying an additional 31,877 shares during the last quarter. HRT Financial LLC acquired a new position in shares of Banco Santander, during the second quarter worth approximately $250,000.

IPG Investment Advisors LLC boosted its position in shares of Banco Santander, by 42.8% in the second quarter. IPG Investment Advisors LLC now owns 58,352 shares of the company's stock worth $229,000 after buying an additional 17,500 shares during the last quarter. Finally, Jarislowsky Fraser Ltd boosted its position in shares of Banco Santander, by 44.4% in the second quarter. Jarislowsky Fraser Ltd now owns 999,755 shares of the company's stock worth $14,937,000 after buying an additional 307,637 shares during the last quarter. Institutional investors and hedge funds own 0.61% of the company's stock.

About Banco Santander,

Banco Santander, SA is a retail and commercial bank. The Bank's principal business is to attract deposits and provide loans. The Bank focuses its wholesale banking offer on providing services to its main customers in local markets. The Banks segments include Continental Europe, United Kingdom, Latin America and United States.