Research analysts at Societe Generale began coverage on shares of Banco Bilbao Viscaya Argentaria S.A. (NYSE:BBVA) in a research note issued to investors on Thursday, StockTargetPrices.com reports. The firm set a "sell" rating on the stock.

Several other equities research analysts also recently commented on the stock. J P Morgan Chase & Co upgraded shares of Banco Bilbao Viscaya Argentaria from a "neutral" rating to an "overweight" rating in a research report on Wednesday, February 15th. Citigroup Inc downgraded shares of Banco Bilbao Viscaya Argentaria from a "neutral" rating to a "sell" rating in a research report on Thursday, November 10th.

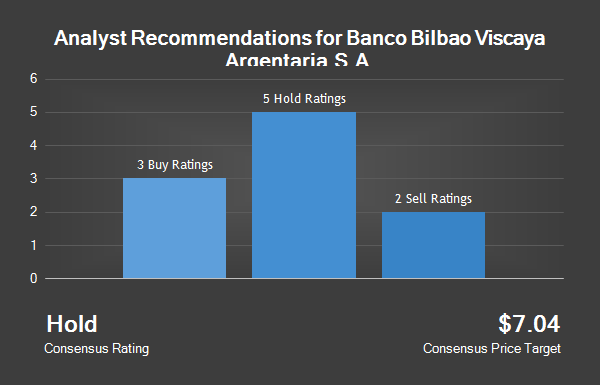

Finally, Jefferies Group LLC downgraded shares of Banco Bilbao Viscaya Argentaria from a "buy" rating to a "hold" rating in a research report on Wednesday, November 9th. Two investment analysts have rated the stock with a sell rating, five have assigned a hold rating and four have issued a buy rating to the company's stock. Banco Bilbao Viscaya Argentaria currently has a consensus rating of "Hold" and a consensus price target of $7.04.

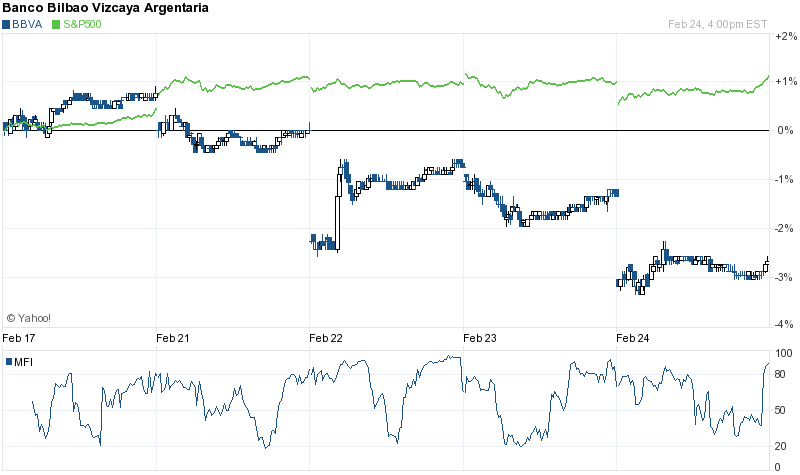

Shares of Banco Bilbao Viscaya Argentaria traded down 0.61% during midday trading on Thursday, hitting $6.53. 2,854,585 shares of the stock traded hands. Banco Bilbao Viscaya Argentaria has a 52 week low of $5.14 and a 52 week high of $7.67. The firm has a 50-day moving average price of $6.67 and a 200-day moving average price of $6.44. The stock has a market capitalization of $42.83 billion, a P/E ratio of 12.32 and a beta of 1.24.

Banco Bilbao Viscaya Argentaria Company Profile

Banco Bilbao Vizcaya Argentaria, SA is a diversified international financial company engaged in retail banking, asset management, private banking and wholesale banking. The Company operates through seven segments: Banking Activity in Spain, Real Estate Activity in Spain, Turkey, Rest of Eurasia, Mexico, South America and United States.