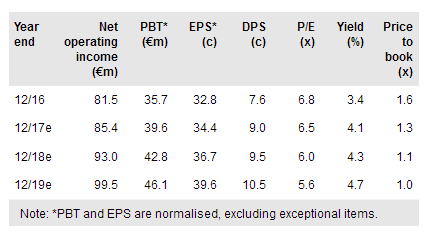

Banca Sistema Spa's (MI:BSTA) Q3 results showed continued growth in its main trade receivables financing and salary and pension-backed loan activities. Reported profits were augmented by a higher accrual rate for late payment interest but, excluding the element relating to prior years, BST still targets an ROAE of 20% for FY17. Given this and the potential for continued growth, the valuation in terms of price to book and multiples of our reduced earnings estimates appears very cautious.

Q317 results

Factoring turnover increased by 25% compared with Q316 and the level of outstanding receivables at the end of the period rose by 19% to nearly €1.3bn. A third of factoring turnover is now originated by BST’s network of partner banks, with three further agreements concluded during the quarter taking the total to 17. Salary and pension-backed loans outstanding nearly doubled to €0.4bn. An increase in the rate of late payment interest accrual complicates comparisons with reported net earnings increasing by 100% y-o-y, while stripping out the impact of the change in accounting completely would leave earnings up only slightly on Q316, in part reflecting the accumulation of loans under legal collection (now at 30% of outstanding).

To read the entire report Please click on the pdf File Below: