Nostradamus predicted that a great nation would rise to unspeakable glory. And then see it all come crashing down.

Was he referring to the United States? Because we may be on the verge of realizing “unspeakable glory.”

Goldman Sachs’ (GS) U.S. Equity Strategist, David Kostin, expects domestic GDP growth to hit 3% in 2014. That’s nearly double the 1.7% growth rate for this year.

That’s not the only shocking revelation in the market, though.

You see, unlike most leading economic indicators, there’s one that’s impervious to manipulation. It’s immune to sentiment, too.

Heck, it’s darn near the closest thing to an economic crystal ball we’ve got.

And it’s suggesting that incredible things are ahead in 2014. Not just for the United States, but for the entire global economy.

We’re Long Overdue

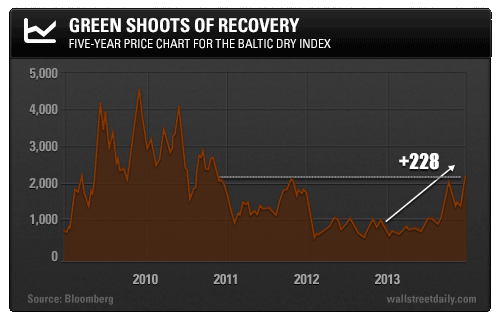

It’s been a long time since we checked in on the Baltic Dry Index (BDI).

For those who don’t know, the BDI is issued daily by the London-based Baltic Exchange and provides “an assessment of the price of moving the major raw materials by sea.”

We’re talking about iron ore, coal, grain, cement, copper, sand and gravel, fertilizer and even plastic granules. Or, more simply, it tracks the precursors of economic output.

Since it targets real-time shipping rates, which fluctuate based on supply and demand, subjectivity can’t creep into the readings. (And deep-pocketed investors with ulterior motives can’t manipulate the index.)

Day in and day out, it provides a snapshot of global economic activity at the earliest possible stage. And the latest readings are unmistakable.

Year-to-date, the index is up nearly 230%. It now rests at its highest level since late 2010.

“For followers of the index, this would indicate that the global economy is picking up steam,” says Bespoke Investment Group.

Indeed!

As we all know, though, appearances can be deceiving, so our work here isn’t done yet. We need to dig into the data to know for sure.

Trust, But Verify

I’m not about to claim that the BDI is perfect. To be fair, the level of global shipping activity isn’t the only variable that goes into determining BDI prices.

The supply of Capesize, Panamax, Supramax and Handysize vessels also plays a role.

How so? Well, even if global shipping activity is constant, an excess supply of ships can lead to competition for business – and, in turn, lower shipping rates. That would show up as a decline in the index, which would inaccurately suggest a downtick in shipping activity.

Conversely, a shortage of shipping capacity could artificially inflate rates, even if actual activity remains constant.

The end result? Instead of taking the price swings of the BDI at face value, we need to trust, but verify. That is, we need to confirm that the supply of ships isn’t unduly influencing shipping rates.

And currently, that’s not the case.

Over the last year, the supply of ships is up by about 4%. So the increase in shipping rates coincides with an increase in shipping capacity, meaning more economic activity is driving the BDI higher.

The Lazy Way to Verify the BDI

Now, if you can’t spend time confirming the validity of BDI price swings with capacity growth, you’re in luck.

We can simply consult another shipping index for confirmation – the HARPEX Index. It focuses on the changes in freight rates for container ships.

Since container ships typically carry a wide variety of finished goods from a multitude of sellers, not just commodities, it’s an indicator of economic activity at the opposite end of the chain of the BDI. (Remember, the BDI measures shipping rates for raw materials.)

And guess what? It’s moving higher, too – up a solid 11% year-to-date.

Bottom line: The data confirms that we’re poised for a global economic recovery. That’s not only good news for us. It’s also great for dry bulk shippers like DryShips Inc. (DRYS), Diana Shipping Inc. (DSX), Navios Maritime Holdings Inc. (NM) and Safe Bulkers Inc. (SB).

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Baltic Dry Index: Closest Thing To An Economic Crystal Ball

Published 12/18/2013, 05:50 AM

Updated 05/14/2017, 06:45 AM

Baltic Dry Index: Closest Thing To An Economic Crystal Ball

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.