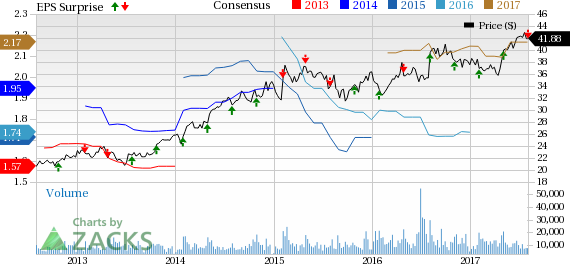

Ball Corporation (NYSE:BLL) reported second-quarter 2017 adjusted earnings of 53 cents per share, missing the Zacks Consensus Estimate of 55 cents. Earnings, however, were up 2% year over year driven by global beverage can growth, contribution from acquisitions and increased aerospace earnings. On a reported basis, the company posted earnings of 28 cents per share compared to $1.06 per share recorded in the prior-year quarter.

Operational Update

Total revenue soared 40.6% year over year to $2.855 billion in the reported quarter. Revenues marginally surpassed the Zacks Consensus Estimate of $2.852 billion.

Cost of sales jumped 42% year over year to $2.27 billion. Gross profit surged 34.8% year over year to $498 million. Gross margin contracted 90 basis points (bps) to 20.5%.

Selling, general and administrative expenses flared up 22% year over year to $128 million. Adjusted operating income decreased 9.2% to $228 million from $251 million in the year-ago quarter. The company reported operating margin of 8%, down 440 bps year over year.

Segment Performance

The Beverage packaging’s North and Central America segment’s revenues jumped 36.4% year over year to $1,151 million in the reported quarter. Operating earnings of $156 million increased 32% year over year.

Sales at the Beverage packaging, Europe segment came in at $665 million in the reported quarter, advancing 38.8% year over year. Operating earnings increased 14.9% year over year to $63 million.

The Beverage packaging, South America segment’s revenues soared 162% year over year to $349 million in the reported quarter. Operating earnings of $69 million recorded a substantial improvement from $22 million in the prior-year quarter.

The Food and Aerosol Packaging segment’s sales came in at $274 million, declining 8% year over year. Operating earnings plunged 24% year over year to $25 million.

In the Aerospace and Technologies segment, sales went up 33% year over year to $257 million. Operating earnings increased 36.8% year over year to $26 million. The segment’s backlog came in at around $1.25 billion at the end of the second quarter.

Financial Condition

Ball Corporation had cash and cash equivalents of $433 million for the six-month period ended Jun 30, 2017, compared with $6,399 million recorded in the comparable period last year. The company recorded cash from operations of $263 million for the six-month period ended Jun 30, 2017, compared with $36 million recorded in the year-earlier quarter. As of Jun 30, 2017, Ball Corporation’s long-term debt decreased to $7,226 million from $8,234 million as of Jun 30, 2016.

Outlook

Ball Corporation reaffirmed its financial goals for 2017 and 2019. The company expects its comparable EBITDA to be $1.75 billion and free cash flow is estimated to be in excess of $850 million after capital spending of at least $500 million. The company remains on track to recognize at least $150 million of the targeted $300 million plus synergies in 2017. Its focus on accelerating actions to reap cost savings will likely benefit the company in 2018 and beyond.

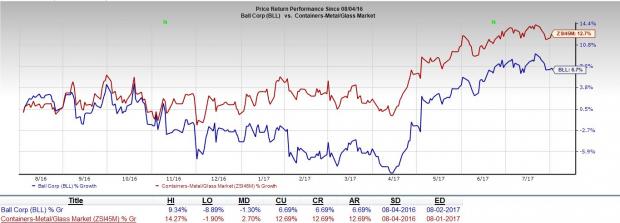

Share Price Performance

Ball Corporation’s share price has underperformed the industry over the past one year. Ball Corporation’s shares gained 6.7% compared with 12.7% growth recorded by the industry over the said time frame.

Zacks Rank and Key Picks

Ball Corporation currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are AGCO Corporation (NYSE:AGCO) , Altra Industrial Motion Corp. (NASDAQ:AIMC) and Apogee Enterprises, Inc. (NASDAQ:APOG) . All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has expected long-term growth rate of 13.51%.

Altra Industrial Motion has expected long-term growth rate of 8.00%.

Apogee has expected long-term growth rate of 12.50%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Ball Corporation (BLL): Free Stock Analysis Report

Apogee Enterprises, Inc. (APOG): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Original post