Baidu Inc. (NASDAQ:BIDU) was downgraded by research analysts at Vetr from a "strong-buy" rating to a "buy" rating in a report issued on Wednesday, MarketBeat.com reports. They currently have a $195.75 price target on the stock. Vetr's target price indicates a potential upside of 6.34% from the stock's previous close.

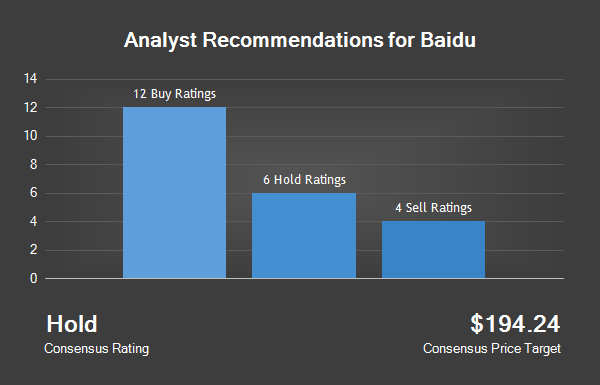

A number of other equities research analysts have also issued reports on the company. Brean Capital reissued a "buy" rating on shares of Baidu in a research report on Tuesday, MarketBeat.com reports. Zacks Investment Research raised Baidu from a "sell" rating to a "hold" rating in a research report on Tuesday, MarketBeat.com reports. Jefferies Group reissued a "buy" rating and issued a $188.00 target price on shares of Baidu in a research report on Monday, MarketBeat.com reports. Bank of America Corp reissued a "sell" rating on shares of Baidu in a research report on Friday, September 30th. Finally, Deutsche Bank AG lowered Baidu from a "buy" rating to a "hold" rating and dropped their target price for the company from $219.00 to $201.00 in a research report on Wednesday, September 28th. Four analysts have rated the stock with a sell rating, seven have assigned a hold rating and fourteen have given a buy rating to the stock. The company presently has an average rating of "Hold" and an average price target of $195.46.

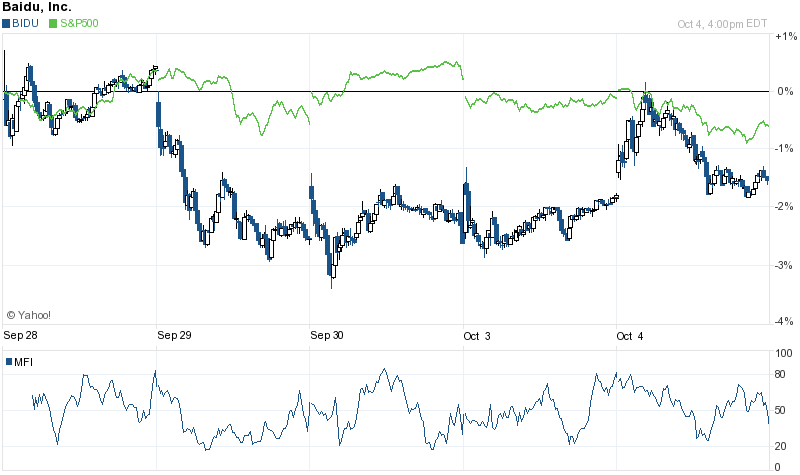

Shares of Baidu (NASDAQ:BIDU) opened at 184.08 on Wednesday, MarketBeat.com reports. Baidu has a 52-week low of $139.61 and a 52-week high of $217.97. The stock has a 50 day moving average price of $181.71 and a 200 day moving average price of $175.23. The company has a market capitalization of $63.80 billion, a PE ratio of 13.54 and a beta of 2.17.

Several hedge funds have recently added to or reduced their stakes in the stock. Causeway Capital Management LLC bought a new stake in Baidu during the second quarter worth $453,930,000. Ruane Cunniff & Goldfarb Inc. bought a new stake in Baidu during the second quarter worth $430,280,000. Franklin Resources Inc increased its stake in Baidu by 126.6% in the second quarter. F{{|Franklin Resources Inc}} now owns 3,706,263 shares of the company's stock worth $612,088,000 after buying an additional 2,070,818 shares during the last quarter. State Street Corp increased its stake in Baidu by 65.9% in the second quarter. State Street Corp now owns 4,368,064 shares of the company's stock worth $721,384,000 after buying an additional 1,735,388 shares during the last quarter. Finally, BlackRock Institutional Trust Company N.A. increased its stake in Baidu by 90.9% in the second quarter. BlackRock Institutional Trust Company N.A. now owns 3,283,368 shares of the company's stock worth $542,248,000 after buying an additional 1,563,274 shares during the last quarter. Hedge funds and other institutional investors own 63.21% of the company's stock.

About Baidu

Baidu, Inc is a Chinese language Internet search provider. The Company offers a Chinese language search platform on its Baidu.com Website that enables users to find information online, including Webpages, news, images, documents and multimedia files, through links provided on its Website. In addition to serving individual Internet search users, the Company provides a platform for businesses to reach customers.