Badger Meter Inc.’s (NYSE:) second-quarter 2017 earnings per share rose 12.5% year over year to a record 36 cents and also beat the Zacks Consensus Estimate of 35 cents.

Sales in the quarter inched up 0.3% year over year to a record $104 million, but fell short of the Zacks Consensus Estimate of $108 million. Domestic residential and commercial municipal water product sales were flat year over year as some customers delayed orders to capitalize on the latest advancement in the ORION Cellular technology, the ORION Cellular Long-Term Evolution (LTE) endpoint, which began shipment in Jun 2017. Domestic sales of flow instrumentation products increased but were partially offset by fewer international projects. The oil and gas business also improved during the quarter.

Cost and Margins

Cost of sales decreased 2% year over year to $63 million. Gross profit in the quarter was $41 million, up 4% from $39.4 million in the prior-year quarter. Gross margin was 39.4%, a 150 basis points (bps) expansion from the year-ago quarter owing to pricing discipline, manufacturing cost controls and its strategy to acquire or consolidate much of distribution network. These actions helped negate the impact of higher brass costs.

Selling, engineering and administration expenses were flat year over year to $24.5 million owing mainly to staffing reductions in the flow instrumentation business in the second half of 2016 and lower health care expenses. Operating income went up 11% to $16.6 million from $14.9 million in the year-earlier quarter. Consequently, operating margin expanded 150 (bps) to 15.9%.

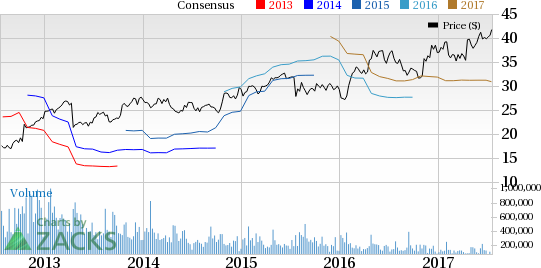

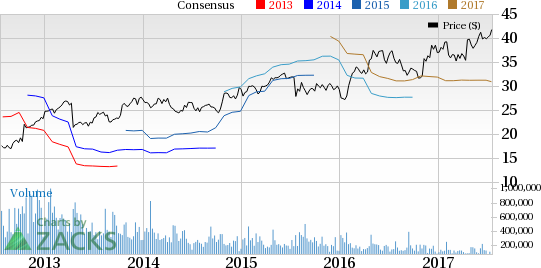

Badger Meter, Inc. Price, Consensus and EPS Surprise

Badger Meter, Inc. Price, Consensus and EPS Surprise | Badger Meter, Inc. Quote

Financial Position

Badger Meter reported cash and cash equivalents of $13.8 million at the end of second-quarter 2017, up from $7.3 million at year-end 2016. Receivables were pegged at $64.4 million at the second quarter end, higher than $59.8 million as of Dec 31, 2016. Inventories were $74 million at the end of second quarter compared with $78 million as of Dec 31, 2016.

Badger Meter acquired D-Flow Technology AB of Luleå, Sweden in the second quarter. D-Flow Technology specializes in the design and development of ultrasonic technology, primarily for use in flow measurement. With this buyout, the company further strengthened its presence in the ultrasonic flowmeter market. The acquisition will help Badger Meter to further enhance its successful E-Series Ultrasonic product line, lower production costs and provide a platform for further advancement of ultrasonic capabilities.

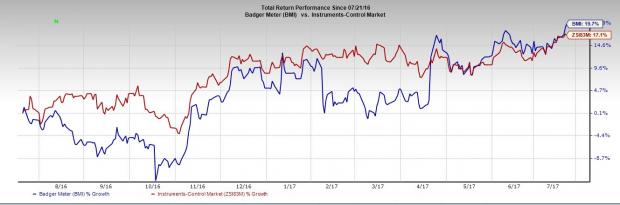

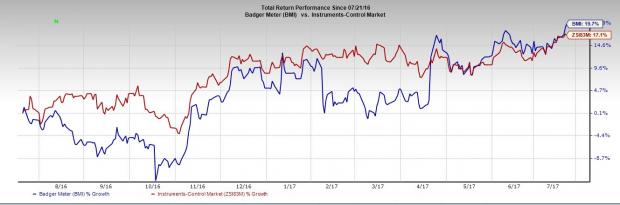

In the last one year, Badger Meter has outperformed the industry with respect to price performance. The stock gained around 19.7%, while the industry rose 17.1%.

Zacks Rank & Key Picks

Badger Meter currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Applied Optoelectronics, Inc. (NASDAQ:) , Axcelis Technologies, Inc. (NASDAQ:) and Broadcom Limited (NASDAQ:) .

Applied Optoelectronics has delivered a average positive earnings surprise of 118.33% in the last four quarters. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Broadcom Limited, a Zacks Rank #1 stock, has an average positive earnings surprise of 6.73% for the past four quarters.

Axcelis Technologies carries a Zacks Rank #2 (Buy) and has delivered an impressive average positive earnings surprise of 135.78% in the trailing four quarters.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis ReportBroadcom Limited (AVGO): Free Stock Analysis ReportApplied Optoelectronics, Inc. (AAOI): Free Stock Analysis ReportBadger Meter, Inc. (BMI): Free Stock Analysis ReportOriginal postZacks Investment Research