Last night, while returning to my apartment, I shared an elevator with a neighbor who was carrying a large paper bag of groceries. Printed on the front was Amazon's (NASDAQ:AMZN) unmistakable “smile” logo and the word “NOW.”

“I haven’t heard of Amazon Now,” I commented. “What’s that?”

“Oh, it’s like Prime,” she said. “But for orders of $35 or more, you get free delivery within two hours.”

That’s right. Amazon Prime Now won’t just do your grocery shopping for you. It’ll do it faster than you can.

Over the last year, we’ve written quite a bit about the decline of big grocery chains like Kroger (NYSE:KR). These brick-and-mortar retailers simply can’t keep up with Amazon - especially now that it owns multiple grocery franchises.

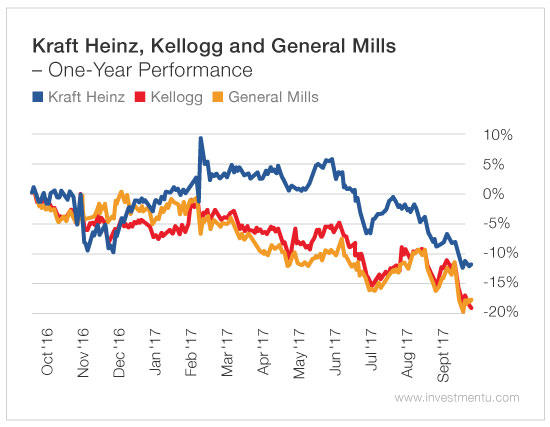

As you can see from this week’s chart, that’s bad news for many consumer staples firms like Kraft Heinz Co (NASDAQ:KHC), Kellogg Company (NYSE:K) and General Mills (NYSE:GIS). These companies draw substantial revenues from distribution agreements with big grocers.

You might argue that this is only a temporary setback for producers of foodstuffs - that they’ll eventually work out new deals with Amazon and replace their ailing grocery partners.

Unfortunately, it’s not that simple. Amazon is only one threat to these brands. Our changing taste buds are an even bigger problem for them.

The End of a Sugary Era

You may notice that two of the companies shown in this week’s chart are principally cereal makers. That’s not a coincidence. America’s love affair with sugary breakfast foods has cooled since its postwar heyday.

Earlier this month, Bloomberg reported that Post Holdings Inc (NYSE:POST) was acquiring Bob Evans’ frozen breakfast foods business for $1.5 billion. The Honey Bunches of Oats maker has noticed that Americans are ditching cereal in favor of hot, savory alternatives - think egg sandwiches and sausage scrambles.

This trend is part of a larger shift away from refined sugars in the American diet. As Matthew Carr wrote back in the spring, we’re abandoning cola as well. Sales of ketchup (aka tomato puree with corn syrup) have also been declining in recent years - a bad omen for Kraft Heinz.

In sum, many consumer staples companies are facing a double whammy right now. Their distribution partners are collapsing under competitive pressure from Amazon. And their products are falling out of favor as our nation loses the sweet tooth it’s had since the 1950s.

One of our own strategists has already told investors to short one of the companies in this chart. And his subscribers are well on their way to making big profits from this recommendation.