"Twenty years from now you will be more disappointed by the things that you didn't do than by the ones you did do.” – Mark Twain

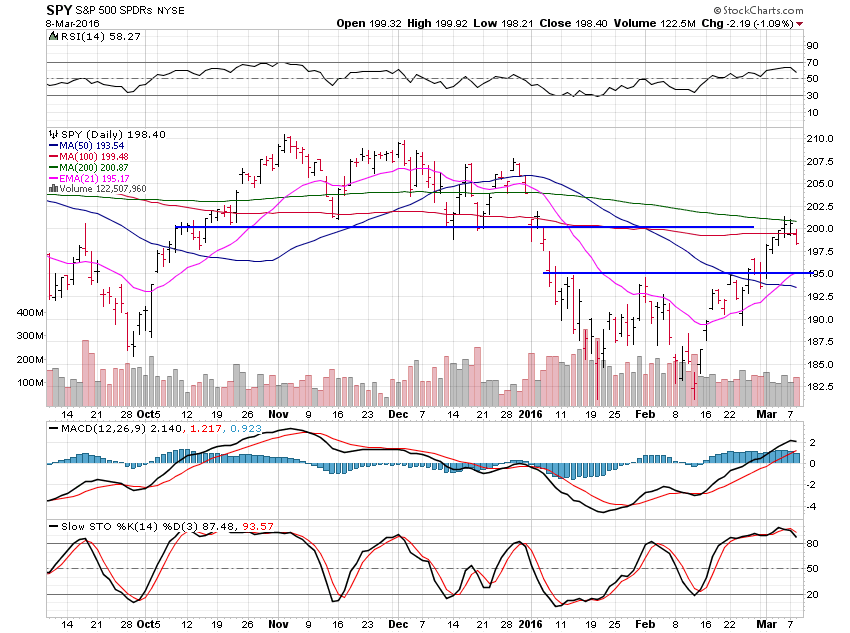

Great action from SPDR S&P 500 (NYSE:SPY) and stocks finally as they are now resting and moving a bit lower and finally working off overbought readings.

If all goes well they shouldn’t move too much lower, rather consolidate and set up for nice breakouts.

It’s been a slow year thus far but it’s looking like setups are nearly complete and we can do some heavy buying, but only time will tell that tale for sure.

Last night my SPY chart was showing wrong for some reason and it was a very bullish pattern but it was not the right chart for some reason.

My apologies for that mistake by www.stockcharts.com, it happens sometimes unfortunately.

SPY is backing away from the 200 day average well and I now look to 195 for support.

I’m not looking to do much shorting but I did grab some VRX short today and held overnight.

Enjoy your evening and really begin to focus on your buying list and looking for the next turn higher over the next week or so.