“The great thing in this world is not so much where you stand, as in what direction you are moving.” – Oliver Wendell Holmes

Well, the sloppy action we saw Wednesday was confirmed on Thursday so I sold all my positions about mid-morning.

No point in hanging around and watching the last few weeks of gains disappear in a day or two.

So, buy and hold isn’t working, but swing trading is so what remains my focus.

A major weak day for indexes so cash is the place to be.

A few days off could be taken now to get your Christmas shopping done with the recent gains we’ve gotten.

I may spot a few short sale candidates tonight but I think we’ve missed that boat.

So, while we’re now in the midst of another correction, it just goes to show that no matter how good the charts are looking, anything can still happen so paying attention to the intraday action very carefully is really a must.

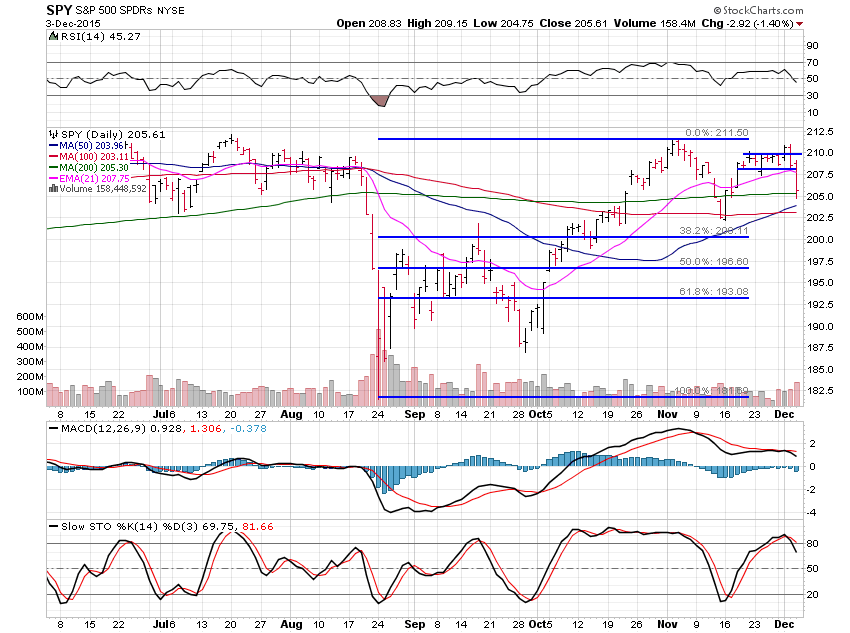

N:SPY broke the channel that looked so good on heavy volume, so I was out.

We were tipped off Wednesday when we came back in the channel and then it was pretty apparent early today that any rally was being sold into so I was one of them.

Great time to relax for a few days before the next swing trade appears.