Bank of America Corp (NYSE:BAC). had an incredible 2017. Shareholders saw BAC stock rise by as much as 36% on the back of strong revenue and earnings growth. This, in turn, led to even higher expectations for the next couple of years with analysts predicting EPS of $2.40 in 2018 and $3 in 2019. In short, as the stock trades near $32 a share, everyone seems to be in love with Bank of America.

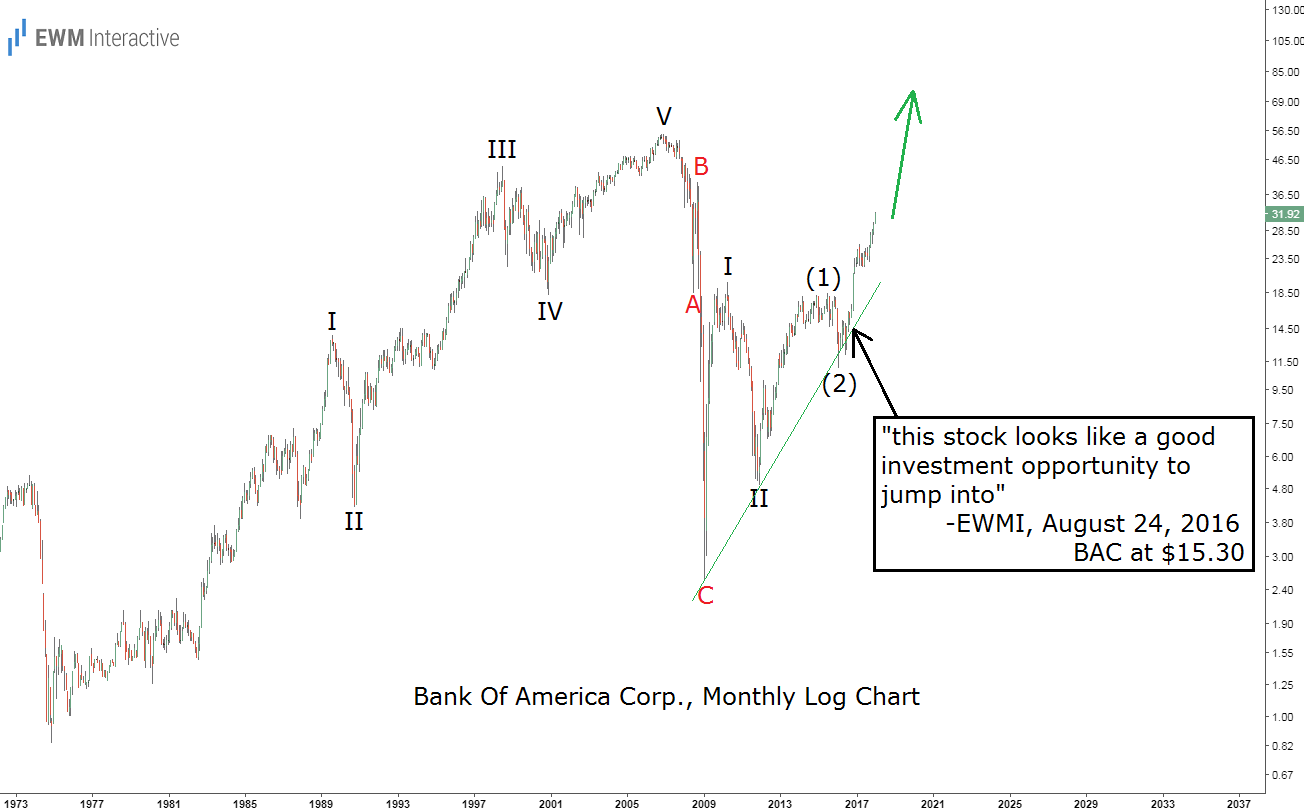

But back in August 2016, when the stock was closer to $15 a share, the majority of investors were still very cautious about it. The Elliott Wave Principle, on the other hand, suggested BAC stock could be “a good long-term bet”. Take a look at the chart below to refresh your memory.

The monthly logarithmic chart above allowed us to see that BAC stock’s entire rally between 1974 and 2006 is a textbook five-wave impulse. This meant the crash from $55 to $2.53 by February 2009 was nothing more than a natural three-wave correction. According to the theory, the uptrend was supposed to continue in the direction of the impulsive pattern, so it made sense to expect more strength in wave (3) up.

In terms of price, BAC stock is still below its 2006 high of $55, but due to the billions of new shares the company was forced to issue in order to survive the Financial Crisis, its market capitalization is already above that of 2006. However, simply extrapolating the current earnings growth into the future in order to justify a higher stock price is a dangerous game. Instead, let’s see an updated chart of BAC stock and find out what the Elliott Wave principle would suggest.

The good news is that so far wave (3) has been sharp and strong just as it is supposed to be. The wave structure gives us no reason to question the initial bullish scenario. Earnings growth expectations and technical analysis align. Despite the fact that BAC stock more than doubled since August 2016, the chart above suggests future is still bright for the second largest bank in the United States. In the long-term, $55 is still there for the taking.