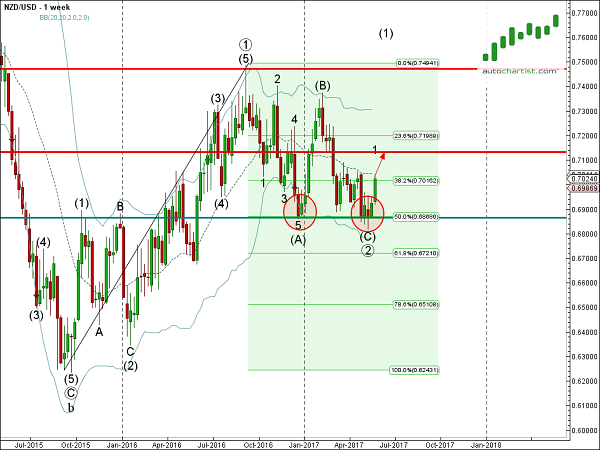

NZD/USD continues to rise after the earlier breakout of the daily Falling Wedge chart pattern which was recently identified by Autochartist. Autochartist measures the Quality of this Falling Wedge at the 7 bar level – which is the result of the significant Initial Trend (7 bars) and above-average Uniformity and Clarity (both rated at the 6 bar level). NZD/USD is expected to rise to the forecast price 0.7133.

As can be seen from the weekly NZD/USD chart below, the bottom of this Falling Wedge formed when the price reversed up from the support zone lying between the major support level 0.6860 (which also reversed the pair in December) and 50% Fibonacci correction of the upward impulse from the middle of 2015. The proximity of this support area increases the probability NZD/USD will continue to rise toward the forecast price 0.7133.