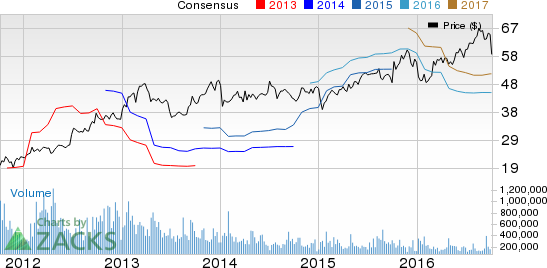

Electrical equipment manufacturer AZZ Incorporated (NYSE:AZZ) posted earnings per share of 55 cents in the second quarter of fiscal 2017 (ended Aug 31, 2016), missing the Zacks Consensus Estimate by 21.4%.

Quarterly earnings were also down 17.9% from 67 cents per share reported in the year-ago period.

The year-over-year decrease in earnings was due to lower operating income from the Energy and Galvanizing segments.

Total Revenue

AZZ reported second-quarter fiscal 2017 revenues of $195 million, lagging the Zacks Consensus Estimate of $222 million by 11.9%. Moreover, quarterly revenues dropped 8.6% from $214.2 million reported last year.

Lower contributions from the Galvanizing and Energy segments led to the decline in the top line.

Fiscal Second-Quarter Highlights

The company’s backlog at the end of the quarter was $352.8 million, up 4.3% from $338.1 million a year ago. Nearly 27% of the backlog is related to customers outside the U.S.

Second-quarter order booking of $193.7 million was down 17% from $233.5 million booked in the comparable prior-year period.

Operating income stood at $14.9 million, down 43.6% from $26.4 million in the prior-year quarter.

Selling, general and administrative expenses came in at $26.9 million, almost on par with the year-ago quarter.

Interest expenses for the fiscal second quarter declined to $3.6 million from $4 million reported in the prior-year period.

Other Key Picks

Investors interested in this space may also consider EnerSys (NYSE:ENS) , Schneider Electric (PA:SCHN) SE (OTC:SBGSY) and AO Smith Corp. (NYSE:AOS) .

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

AZZ INC (AZZ): Free Stock Analysis Report

SMITH (AO) CORP (AOS): Free Stock Analysis Report

SCHNEIDER ELECT (SBGSY): Free Stock Analysis Report

ENERSYS INC (ENS): Free Stock Analysis Report

Original post