AXIS Capital Holdings Limited (NYSE:AXS) has raised the offer price for buyout of Novae Group plc through its whole owned subsidiary, AXIS Specialty UK Holdings Limited.

The insurer has made a final offer of 715 pence in cash per Novae share, up from 700 pence in cash per share of the same, offered earlier. The final offer price thus comes to $611.6 million (£477.6 million).

Earlier on Jul 5, the Zacks Rank #3 (Hold) insurer had announced to purchase Novae Group for $605 million in cash. This acquisition is expected to ramp up the acquirer’s Lloyd’s presence. (Read: AXIS Capital to Buy Novae & Consolidate Lloyd's Presence).

The new offer price translates to a premium of about 23% to the closing price of 581 pence per Novae share on Jul 4 or 31% to the volume weighted average closing price per Novae share for a month-long period up to and including Jul 4.

The purchase consideration of £477.6 million equals 1.5x Novae’s reported net tangible book value of £318.8 million as of Dec 31, 2016 or 1.6x Novae’s reported net tangible book value of £300.6 million as of Jun 30, 2017. AXIS Capital will deploy available cash to fund this transaction or even go for new borrowings, if market conditions favor.

London-based Novae Group is a diversified property and casualty insurer operating through Syndicate 2007 at Lloyd’s. This takeover will hence boost AXIS Capital’s Lloyd presence. Also, addition of Novae Group to AXIS Capital’s portfolio will place the acquirer within the top 10 insurers’ bracket at Lloyd as it already emerges a $2 billion worth insurer in the London specialty market. The transaction will be accretive to the acquirer’s bottom line and return on equity in the first year post its closure.

Novae Group can benefit from AXIS Capital’s strong financial positon as well as compelling resources to expand underwriting businesses.

AXIS Capital eyes strategic acquisitions to gain competitive advantage. Last November, the company had announced to acquire the general aviation insurance and reinsurance leader, Aviabel, to leverage position in the global aviation market. With the A&H (Accident & Health) business started showing an upturn, AXIS Capital acquired Ternian Insurance Group to brace its A&H retail distribution in the U.S.

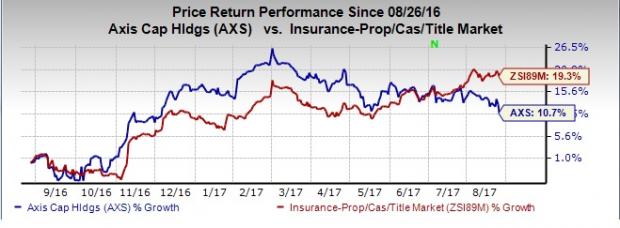

Shares of AXIS Capital have underperformed the industry in a year’s time. While the company’s shares have rallied 10.68%, the industry gained 19.23%. Also estimates moved south over the last 60 days. Nonetheless, we expect company’s sustained efforts to expand capabilities and accelerate growth to drive the shares higher.

Buyouts not only widen a company’s geographical footprints but also enhance its portfolio of services. Acquisitions thus rage the insurance space. This month, Arthur J. Gallagher & Co. (NYSE:AJG) acquired Ballard Benefit Works, Inc. to enhance its employee benefits consulting and brokerage operations in the United States. Brown & Brown, Inc. (NYSE:BRO) via its subsidiary, Pacific Resources Benefit Advisors, LLC, closed the acquisition of all the assets of herronpalmer LLC to enhance its advisory services. Last month, The Hanover Insurance Group, Inc. (NYSE:THG) has announced that its international specialty insurance group, Chaucer, has bought SLE Holdings to bolster the acquirer’s specialty capabilities. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG): Free Stock Analysis Report

Axis Capital Holdings Limited (AXS): Free Stock Analysis Report

The Hanover Insurance Group, Inc. (THG): Free Stock Analysis Report

Original post