AXIS Capital Holdings Limited (NYSE:AXS) reported second-quarter 2017 earnings of $1.31 per share that surpassed the Zacks Consensus Estimate by nearly 4%. Also, earnings skyrocketed 157% from the year-ago quarter

Including net realized investment losses of 5 cents, foreign exchange losses of 43 cents, and bargain purchase gain of 18 cents, net income came in at $1.01per share, down about 22% year over year.

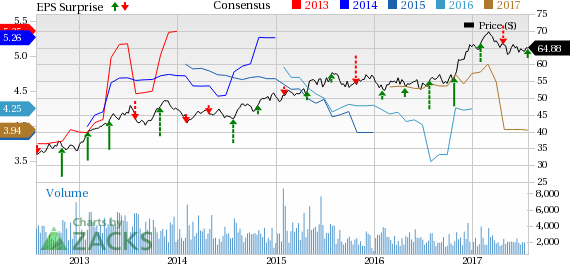

Axis Capital Holdings Limited Price, Consensus and EPS Surprise

Operational Update

Operating revenues of about $1.09 billion beat the Zacks Consensus Estimate of $1.05 million. Revenues increased 5% year over year.

Gross premiums written increased 3% year over year to about $1.4 billion. The improvement was driven by 6% higher premiums written in the Reinsurance segment and 2% higher premiums written in the Insurance segment.

Net investment income increased 16% year over year to $106 million driven bychange in fair value of alternative investments.

Total expense in the quarter increased 9% year over year to $1 billion due to higher acquisition costs and administrative expenses.

AXIS Capital’s underwriting income increased nearly six folds year over year to $57 million. Combined ratio improved 460 basis points (bps) to 97.6%. Catastrophe and weather-related pre-tax net losses were $41 million compared with $49 million in the year-ago quarter.

Segment Results

Insurance: Gross premiums written increased 2% year over year to $796 million owing to the acquisition of the aviation business of Aviael and a better performing liability line of business.

Net premiums earned increased 3% year over year to $493 million on premium growth in accident, health and property lines.

Underwriting loss of $0.5 million narrowed from the year-ago loss of $11.4 million. Combined ratio improved 30 bps to 100.2%.

Reinsurance: Gross premiums written in the quarter increased 6% year over year to $566 million, largely due to a higher level of premiums in the motor, catastrophe and property lines partially offset by a decline in the agriculture line.

Net premiums earned decreased 4% year over year to $487.6 million on premium growth in the agriculture line.

Underwriting income of $57.4 million increased from $21.2 million in the year-ago quarter. Combined ratio improved 710 bps year over year to 97.6%.

Financial Update

AXIS Capital exited the quarter with cash and cash equivalents of $728 million, down 30% from the 2016-end level.

Cash flow from operation was $185 million compared with $77 million in the year-ago quarter.

As of Jun 30, 2017, diluted book value per share was $60.45, up 5% year over year.

Operating return on equity was 8.6% compared with 3.6% in year-ago quarter.

Share Repurchase and Dividend Update

The company repurchased 2 million shares for $131 million. AXIS Capital has $739 million remaining authorization under the common shares’ repurchase program up to Dec 31, 2017. But it has been suspended due to the acquisition of Novae.

The company declared a dividend of 38 cents per common share.

Zacks Rank

Arch Capital Group presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported their second-quarter earnings, the bottom line at Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc. (NYSE:FNF) beat their respective Zacks Consensus Estimate. The Progressive Corporation (NYSE:PGR) missed the same.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.See these stocks now>>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Axis Capital Holdings Limited (AXS): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post

Zacks Investment Research