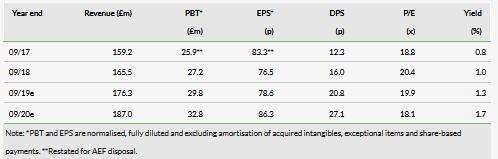

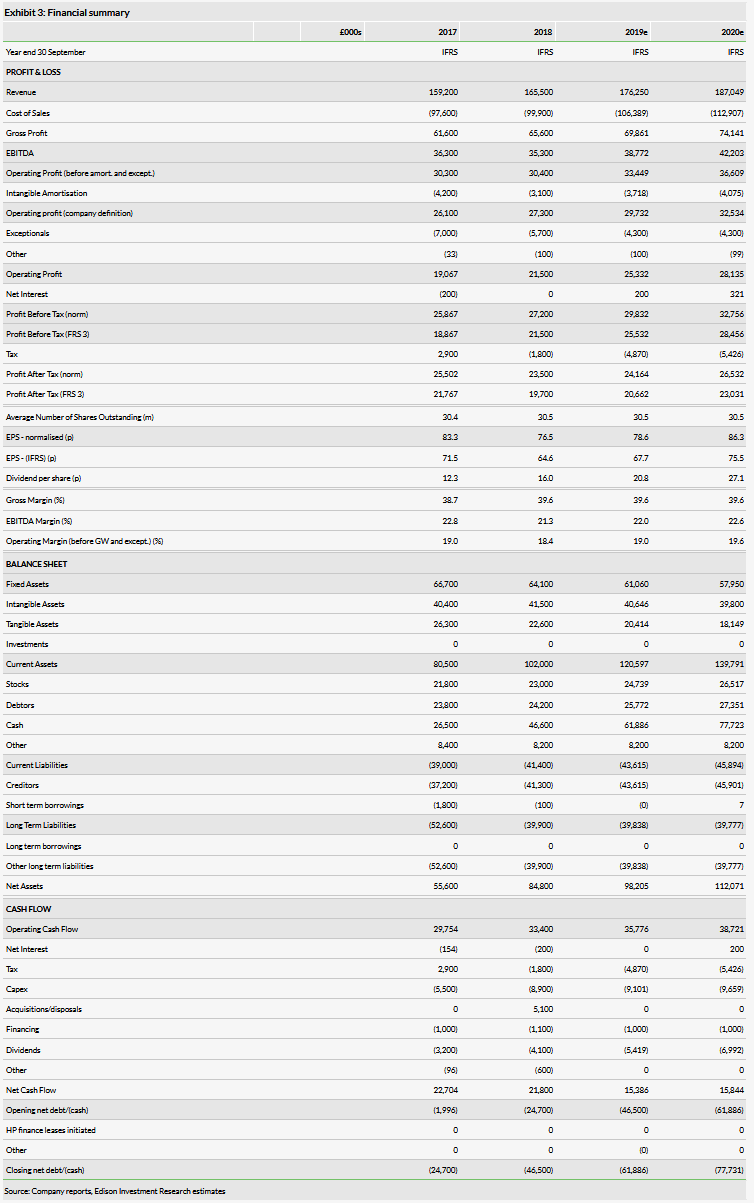

In its largest acquisition to date, Avon Rubber is buying the ballistic protection assets of 3M (NYSE:MMM), a market leader in the U.S. The purchase price of an initial $91m could increase by a further $25m depending on the outcome of tenders for legacy products. Subject to approvals, the deal should complete by fiscal Q220 and be immediately earnings enhancing, creating value in FY21, its first full year of ownership. Avon has also indicated that trading remains in line with management expectations, so our forecasts remain unchanged at present. We will update our forecasts for the acquisition when it completes in FY20.

U.S. leader in helmets and body armour

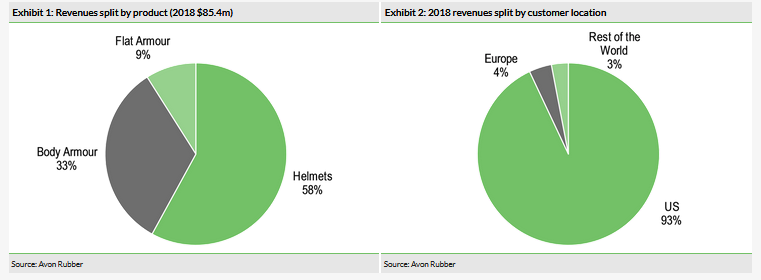

Avon is buying the assets of 3M’s ballistic protection business including the Ceradyne brand helmets and body armour activity. The acquisition is in line with one of the group’s strategic goals of creating value through targeted acquisitions to complement the existing product portfolio and add growth opportunities. It has strong positions with the U.S. Department of Defense (DOD) supported by excellent R&D capabilities. It has just started fielding the low rate initial production (LRIP) volumes of helmets and body armour for the US DOD Soldier Protection System (SPS) programme, which should provide growth as it moves into full production. Of its $85.4m of revenues in 2018, 93% are for U.S. customers, so Avon Protection sees further potential from leveraging its international sales network.

Compelling financial case

Subject to approvals the deal should complete in Avon’s Q220. The business generates EBIT margins of around 10% currently. Avon management believes it can generate $5m of annual cost synergies by FY21 for an upfront cost of $10m, which should leave ROIC in double digits and well ahead of WACC, creating shareholder value. The initial consideration is being funded from cash resources and an increased three-year revolving credit facility (RCF) of $85m. Group net debt to EBITDA is expected to not exceed 1.0x.

Valuation: Significant EPS enhancement expected

We maintain our estimates at present, in line with the trading comment, as we do not incorporate acquisitions into our estimates until a deal completes. However, we would expect an enhancement to earnings in the region of 20% in a full year post cost synergies. As the acquisition and business case is executed, we would expect Avon’s valuation to respond accordingly.

Business description

Avon Rubber designs, develops and manufactures products in the protection (70% of 2018 sales) and dairy (30%) sectors. Its major contracts are with national security organisations such as the US DOD. Over 70% of 2018 sales were from the US.

Record acquisition progresses growth strategy

Avon has been exploring targeted M&A opportunities as an element of its three-pronged growth strategy. These are designed to augment organic growth from the existing product portfolio while maximising operational efficiency, enhanced by selective product development to maintain its cutting-edge technology and leadership in innovation. The business employs 280 people and operates from three well invested sites in the U.S.; the main site is Irvine in California, with additional ceramic plate production in Lexington, Kentucky, and additional assembly and production capacity at Salem in New Hampshire, where the R&D centre for the business is located.

Rationale for the deal

The agreed purchase of 3M’s ballistic protection assets maintains Avon’s financial discipline in M&A deals. It has secure, organically growing and profitable revenue streams, expands the technology range of the group with leading market positions and brands and brings a strong management team with it. It should enhance earnings, create value and augment cash flows, allowing Avon to maintain a strong post-deal balance sheet.

The business has a leading position in the U.S. supplying helmets and body armour. Its products appear to be almost entirely complementary to Avon Protection’s existing mask systems operations in the U.S. Both supply critical personal protection products to the US military and law enforcement agencies.

Extending the critical personal protection product range

The operations to be acquired are:

The company supplies the Advanced Combat Helmet (ACH) and Enhanced Combat Helmet (ECH) for the US Armed Forces. Its excellent product development has provided the next generation Integrated Head Protection System (IHPS) for the SPS programme, which has just commenced the sole sourced LRIP. The contracts for full rate production (FRP) are expected to be awarded by 2021, the transition to which should organically grow revenues,

In body armour, the business is the sole source LRIP supplier of Vital Torso Protection (VTP) body armour under the SPS programme. Together with two other suppliers, an FRP contract worth a combined maximum of $704m over four years has been awarded. Deliveries are expected to commence in late 2020, further boosting organic growth in both 2020 and 2021.

Opportunity to generate both cost and revenue synergies

Management believes there are $5m of costs to be extracted as the back office and central head office operations of the new business are transitioned to and integrated with Avon’s systems. The company is expecting one off costs of $10m to achieve these benefits by FY21.

In its business case value creation is not contingent on sales synergies, but there is clear potential for these to be achieved as well. At present most of the US sales go to the DOD, around 90% of the total, meaning only around 3% of sales go to law enforcement agencies. Avon Protection clearly believes it has the potential to extend penetration of the law enforcement and other domestic US markets. In addition, only 7% of sales went to overseas markets, and with Avon Protection’s international sales network there is clearly potential for that to increase subject to any export licence restrictions.

The transformational increase in scale of Avon Protection should also further enhance its overall reputation and brand around the globe, hopefully providing additional leads in both domestic and export markets.

Financial metrics appear compelling

Avon is paying an initial $91m subject to normal closing adjustments, for gross assets of $45.2m that generated FY18 revenues of $85.4m, EBITDA of $10.8m and PBT of $3.3m. Subject to the award of pending tenders for legacy products, a maximum of a further $25m would become payable, but we expect any awards to enhance the business case. The deal is subject to CFIUS and other U.S. regulatory approvals, but given the complementary nature of the product ranges and Avon’s existing U.S. presence, we do not see these as potential obstacles to completion, which is expected in fiscal Q220.

Avon has substantial cash resource and has renewed and increased its three-year RCF to $85m. These resources will be used to pay for the deal, adding around $1.0–1.5m per year of interest, peaking in the year of acquisition. The deal is immediately EPS enhancing and adding $5m of cost savings will make it value creating in FY21, further enhanced by organic development from the SPS programme.

Management expects the activity to have cash conversion consistent with the existing business, which is itself highly cash generative. Net debt to EBITDA is expected to be below 1.0x when the deal completes and, assuming all goes to plan, management expects to be in a net cash position by the end of FY21.