Beauty products retailer, Avon Products, Inc. (NYSE:AVP) , seems to going through a rough phase for quite some time now.

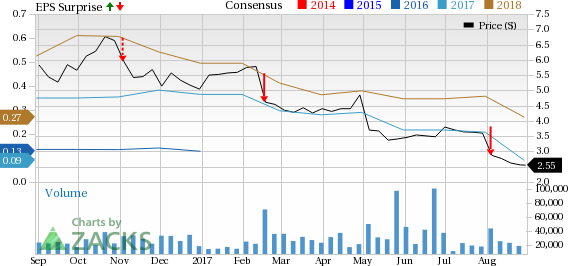

Shares of this Zacks Rank #5 (Strong Sell) company touched a 52-week low of $2.50 yesterday, though it recovered slightly to close the day at $2.55. Further, the stock has plunged over 49% year to date, as against the Zacks Cosmetics industry’s gain of 3.2%. In fact, its shares have declined nearly 30% in a month due to dismal second-quarter 2017 results. Currently, the industry ranks in the top 35% of the Zacks classified industries (90 out of 256).

Dismal Performance & Soft Guidance

We note that Avon has long been struggling owing to weak Active Representatives growth and adverse currency translations. In fact, both its top and bottom lines missed the Zacks Consensus Estimate for the fourth straight quarter, when the company reported second-quarter results. Also, Avon has been incurring losses for the last two quarters.

Results in the second quarter were mainly impacted by strong comparisons with the prior-year quarter. Additionally, it was hurt by decline in both Active Representatives and Ending Representatives across all the segments, barring Ending Representatives growth in North Latin America.

Consequently, management now expects revenue growth for 2017, on constant-dollar basis, to be at the low-end of its previous guidance range of low-single-digit growth. (Read: Avon Falls on Q2 Loss & Sales Lag, Cuts FY17 View)

Downward Spiral in Estimates

The Zacks Consensus Estimate for Avon declined sharply over the last 30 days, following the dismal quarter and bleak outlook. Over the said time frame, four earnings estimates have gone lower for both 2017 and 2018.

Notably, the Zacks Consensus Estimate of 9 cents for 2017 and 27 cents for 2018 moved down 11 cents and 9 cents, respectively.

Other Headwinds/Concerns

Avon faces intense competition from cosmetics products retailer like Inter Parfums, Inc. (NASDAQ:IPAR) , in domestic and international markets. Globally, the company competes with products sold to consumers by other direct-selling and direct-sales companies and through the Internet, and against products sold through the mass market and prestige retail channels.

In fact, as Avon operates in a consumer centric market, its ability to garner profits depends largely on how well it can predict changes in consumer preferences and spending patterns for beauty products, and respond in a timely manner to fulfill the same. Additionally, material shifts in market demand for a product and other macroeconomic headwinds may ultimately hurt the company’s results.

Transformation Plan - A Revival Strategy?

The stringent focus and swift progress on the Transformation Plan could be rewarding for the company.

Interestingly, Avon is in the second year of its three-year Transformation Plan that was announced in January 2016. This plan mainly focuses on investing in growth, enhancing cost structure and improving financial flexibility.

Crossing the half-way mark of the plan period, the company has witnessed significant progress compared to its targets of enhancing cost structure and improving financial resilience.

In 2017, management targets cost savings of $230 million, including run-rate savings from 2016 along with in-year savings from current year initiatives. Meanwhile, the company stated that savings realized through first-half indicate that it is on track to achieve its goals for 2017.

With regard to investing in growth, management plans to invest nearly $350 million over the three-year period, including $150 million toward media and social selling as well as $200 million for service model evolution and information technology. This expenditure is mainly aimed at bolstering the overall Representative experience.

Bottom Line

In such times of struggle, Avon’s Transformation Plan seems to be a ray of hope for the company but it is also failing to spark a turnaround in its current performance now. Hence, it would be advisable to stay away from the stock unless the success of its Transformation Plan starts to reflect in the company’s performance.

Want to Know About the Gems in the Same Industry?

Better-ranked stocks in the same industry include The Estee Lauder Companies Inc. (NYSE:EL) and Nu Skin Enterprises, Inc. (NYSE:NUS) .

Estee Lauder looks good with long-term earnings growth rate of 11.8% and a Zacks Rank #1 (Strong Buy). Also, its earnings have outpaced the Zacks Consensus Estimate in each of the trailing four quarters, with an average of 13.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nu Skin Enterprises, with long-term earnings growth rate of 8.7%, has pulled off an average positive earnings surprise of 10.8%. Currently, it carries a Zacks Rank #2 (Buy).

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Avon Products, Inc. (AVP): Free Stock Analysis Report

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

Original post

Zacks Investment Research