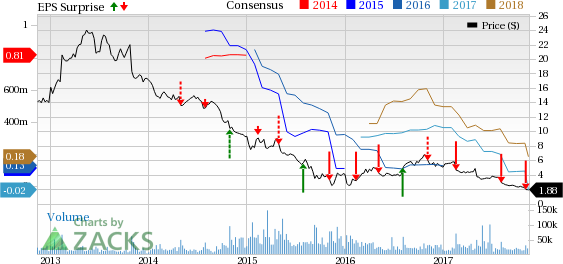

Avon Products, Inc. (NYSE:AVP) has underperformed the industry in the past year owing to its dismal earnings surprise history. In fact, third-quarter 2017 also marked the company’s fifth straight quarter of earnings miss. The company has been witnessing declining Representatives for the past few quarters as well.

Shares of this Zacks Rank #5 (Strong Sell) company have plunged nearly 66.4% in a year, as against the industry’s growth of 14.2%.

Why the Downside?

Avon has delivered an average negative earnings surprise of 98.7% in the trailing four quarters. In the third quarter, the company posted adjusted earnings of 3 cents per share that lagged the Zacks Consensus Estimate of 7 cents.

Meanwhile, the comapny has been struggling with waning Active Representatives and Ending Representatives. Evidently, Active Representatives declined 3% year over year and Ending Representatives dipped 2% in the quarter.

Furthermore, operating margin has been under pressure for quite some time. Operating margin contracted 70 bps to 6.3% in the third quarter owing to higher bad debt expenses along with increased Representative, sales leader and field expenses, all mainly in Brazil.

Though Avon expects modest growth in fourth quarter due to improving trends witnessed in various markets, results are likely to lag expectations in 2017.

Additionally, Avon faces intense competition from cosmetics products retailer like Coty Inc. (NYSE:COTY) in domestic and international markets. Changing market trends and evolving consumer preferences might also weigh upon the company’s performance and hurt its overall profitability.

Estimates Trending Downwards

The Zacks Consensus Estimate for 2017 has moved down from 9 cents to a loss of 2 cents in the last 30 days. Also, the estimate for 2018 has declined by 9 cents to 18 cents.

Transformation Plan Holds Promise

Avon’s Transformation Plan is progressing well with progress against its targets of enhancing cost structure and improving financial resilience. The plan mainly focuses on investing in growth, enhancing cost structure and improving financial flexibility. Crossing more than the half-way mark of the plan period, the company has roughly $25 million outstanding to achieve its savings target for 2017.

Bottom Line

Though Avon has been striving hard to drive growth through innovations, solid team execution, improving Representative experience, recent dismal performances suggest trouble down the road.

Meanwhile, you can count upon some better-ranked cosmetics stocks such as The Estee Lauder Companies Inc. (NYSE:EL) and Inter Parfums, Inc. (NASDAQ:IPAR) .

Estee Lauder, with a long-term earnings growth rate of 12.5%, has pulled off an average positive earnings surprise of 18% in the last four quarters. Also, the stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inter Parfums, with a long-term earnings growth rate of 12.3%, has a Zacks Rank #2 (Buy). Also, it has delivered an average positive earnings surprise of 19.1% in the last four quarters.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Avon Products, Inc. (AVP): Free Stock Analysis Report

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Coty Inc. (COTY): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

Original post

Zacks Investment Research