Key Points:

- Approaching strong historical zone of resistance.

- The pair has moved into overbought territory.

- 100 EMA making its influence patent.

For those looking to sidestep some of the turmoil of the US Election, taking a look at some more exotic crosses could be worthwhile. One such exotic worth investigating is the EUR/JPY which could be setting up for a near to medium-term reversal over the coming sessions. Largely, this should be the direct result of another failed attempt to breach the current zone of resistance but a few other factors are also in play.

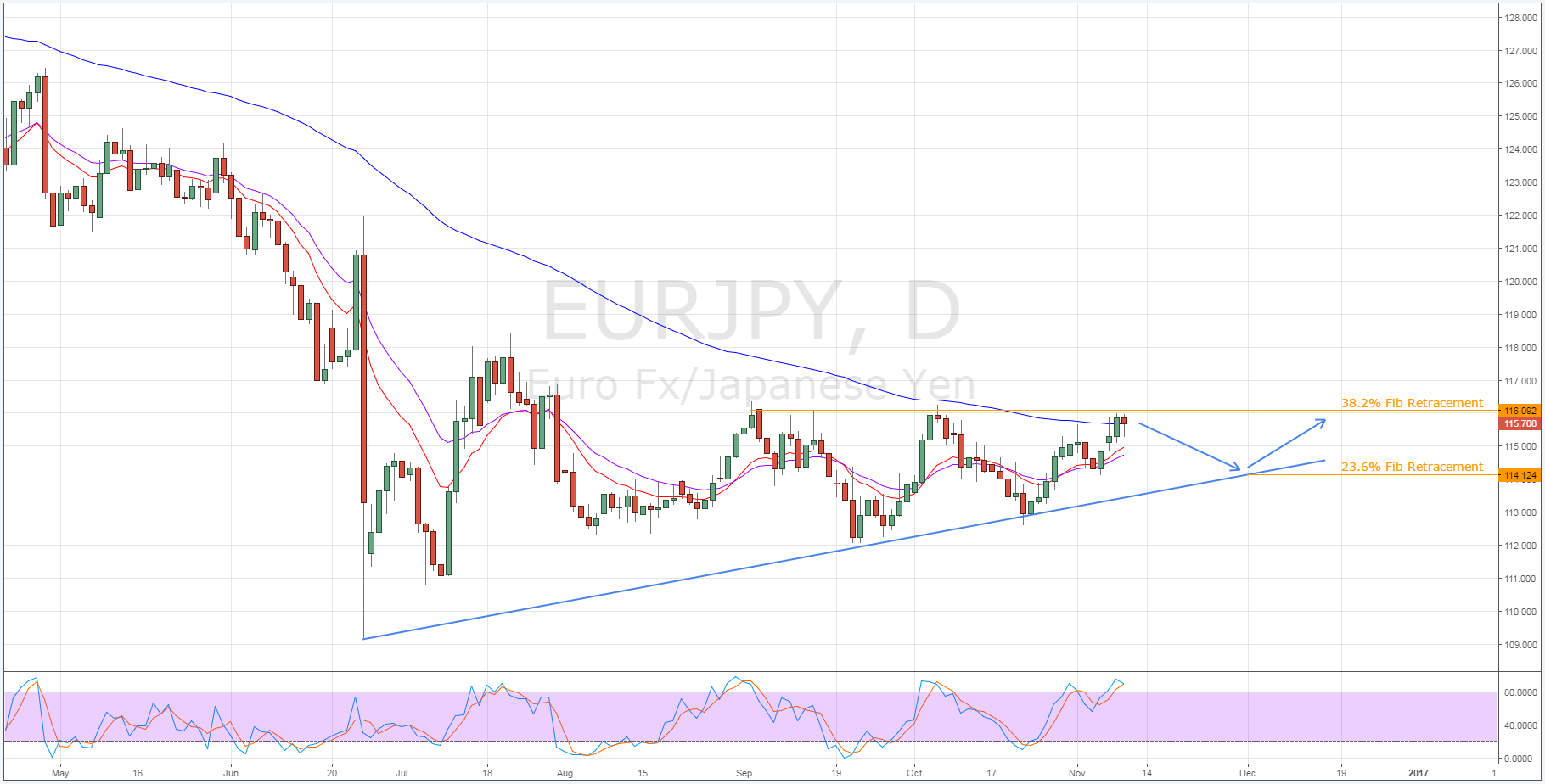

Looking at the pair’s daily chart shows that, ostensibly, the EUR/JPY is having some difficulty breaking through resistance around the 116.09 level. Given that this price represents the 38.2% Fibonacci level, it is little surprise that we have consistently seen the pair fail to push higher during previous attempts at breaking free of its ranging phase.

However, this time around there are a number of other technical forces working to, hopefully, ensure that EUR/JPY makes a reversal in the coming session. Notably, the 100 day EMA is providing some fairly strong resistance which should reinforce the already significant zone of resistance around the 116.09 price. Aside from the 100 day moving average, there is one other factor signalling that selling pressure should begin to mount moving forward. Namely, the stochastic oscillator has drifted into a fairly heavily overbought reading which will be stirring up the bears out there.

Whilst a slide lower looks to be relatively inevitable, just where the near-term bearishness will end is somewhat less certain. Currently, we expect to see the pair move as low as the 114.12 mark which would bring it into conflict with the long-term rising trend line. This trend line has proven to be a solid source of support on a number of prior routs and it’s expected that this holds true moving forward. Additionally, moving to the 114.12 mark would bring the EUR/JPY back to the 23.6% Fibonacci level which will also be generating some support.

Ultimately, even a non-USD pair will be feeling the effects of the US presidential race but the EUR/JPY has been performing relatively consistently over the past few weeks which offers a modicum of insulation. However, do keep an eye on the EU and Japanese fundamentals as the week moves ahead as they are likely going to impact the pair significantly.