The buy and hold investing strategy has proven its merits as a way to build wealth over long periods of time. More often than not, holding the stock of quality companies can lead to sizeable and even life-changing gains.

Successful investors known for adopting this approach, such as Warren Buffett, have long demonstrated its benefits. However, holding the wrong stocks at the wrong time can quickly lead to huge losses. That is just what happened with DexCom (NASDAQ:DXCM) stock.

We wrote about DXCM a little over a month ago, on Apr. 23. The stock was hovering around $440 a share, down from a recent peak at $537. Some might have seen this dip as a buying opportunity, pointing to the company’s rapid sales growth and pristine balance sheet.

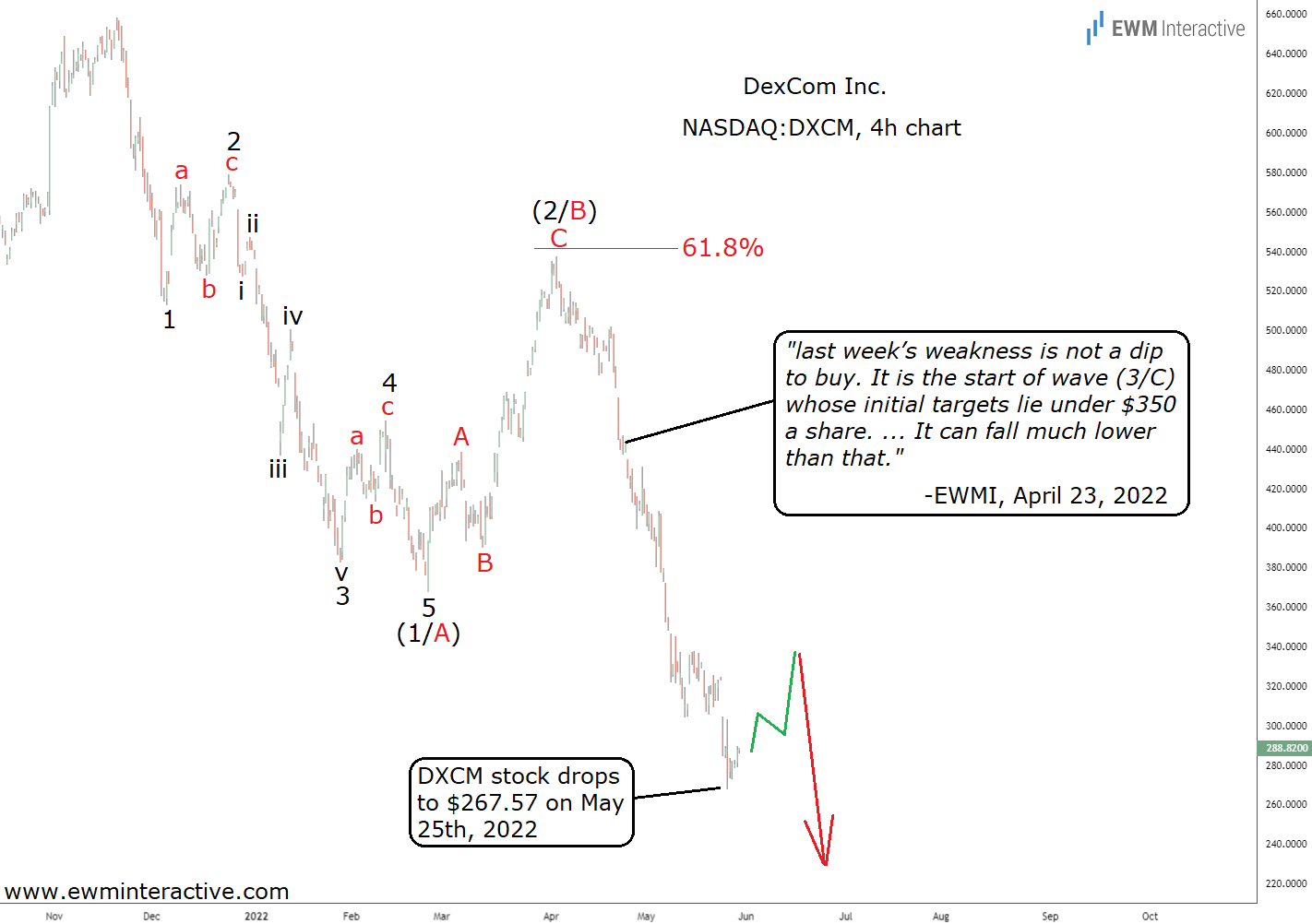

DexCom's extremely high valuation and the Elliott Wave chart below, however, sent a very different message.

The 4-hour chart of DexCom revealed a textbook 5-3 Elliott Wave cycle. Its first part was a five-wave impulse pattern, labeled 1-2-3-4-5 in wave (1/A). It was followed by a simple A-B-C zigzag up to the 61.8% Fibonacci resistance level.

According to the theory, the trend was supposed to resume in the direction of the impulsive sequence.

Elliott Wave Analysis Put Us Ahead of DexCom's Q1 Earnings Disappointment

With that in mind, we opined that “last week’s weakness is not a dip to buy. It is the start of wave (3/C) whose initial targets lie under $350 a share. The problem is that it can fall much lower than that.” We had no idea how fast that prediction was going to come true, though.

The bears didn’t leave the bulls a chance. By May 25, DexCom stock was already trading below $270, down almost 40% since our Apr. 23 article.

With the benefit of hindsight, one could easily explain the crash with the company’s “mixed” Q1 earnings report on Apr. 28. In our opinion, that is just another example of the Elliott Wave principle’s ability to put traders and investors ahead of the news.

The Q1 report, after all, was published five full days after our bearish analysis.

Now, is DexCom stock finally a Buy following its 59% decline from its November, 2021, record? We remain skeptical. DXCM is still trading at an earning and sales multiples that belong somewhere in wonderland.

It makes a lot more sense for wave (3/C) to extend even further to the downside than to end at $268. Thanks to Elliott Wave analysis, that is someone else’s problem. Chances are DXCM will not make it into the EWM Interactive Stock Portfolio anytime soon.