Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

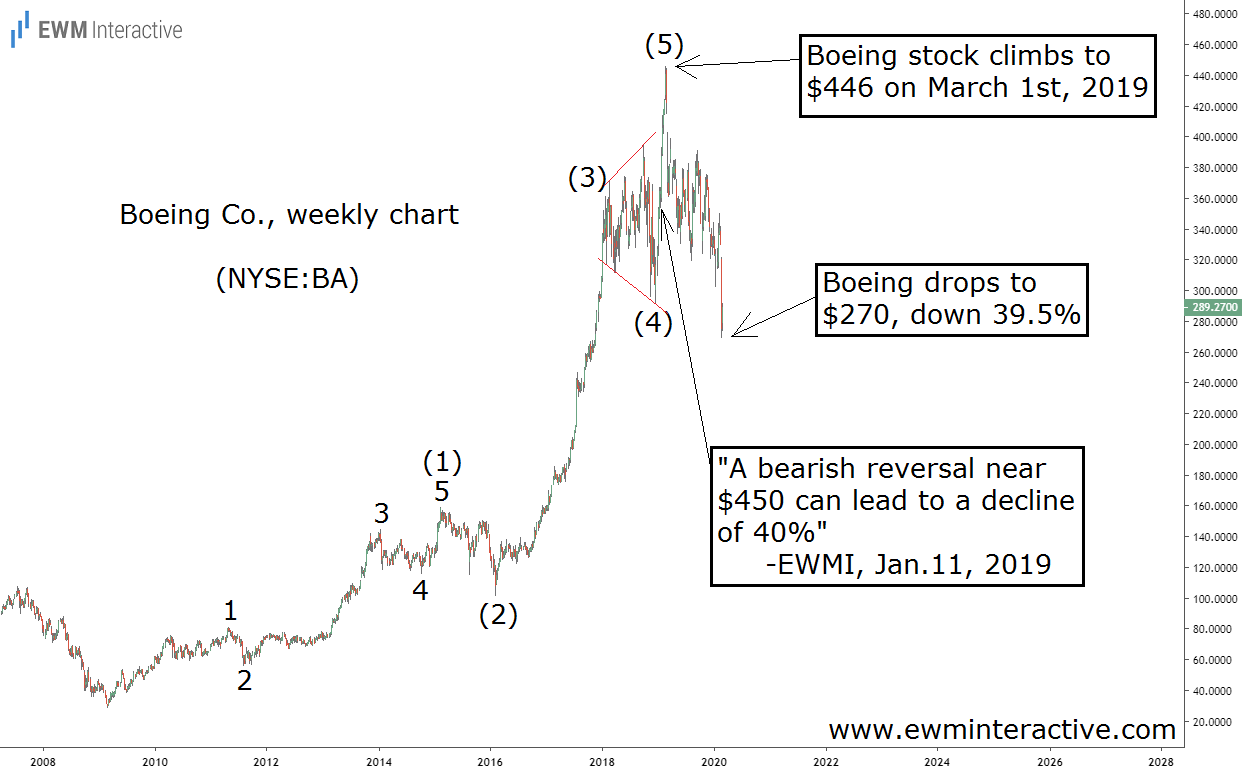

The past year has been a real nightmare for Boeing (NYSE:BA) investors. The stock reached an all-time high of $446 a share on March 1st, 2019. And just when it looked like the sky is the only limit, things took a sharp turn for the worse.

Two of the company’s 737 MAX planes crashed within five months, killing all 346 people aboard. The investigation found that a software glitch has been causing the planes to nosedive. As a result, aviation regulators around the world decided to ground the planes until further notice. The company estimated the groundings of the 737 MAX would cost $18.4 billion. In December 2019, Boeing’s CEO stepped down.

In the meantime, Wall Street was severely punishing Boeing (NYSE:BA). The company-specific crisis coincided with a sharp selloff in the general stock market. The stock fell from $446 a year ago to as low as $270 at the end of last month. At that point, BA was down 39.5% from its record high.

The 737 MAX disaster came as a complete surprise even to the majority of Boeing’s employees. The stock’s decline, on the other hand, could have been predicted. The chart below was published on January 11th, 2019, two full months before the groundings started.

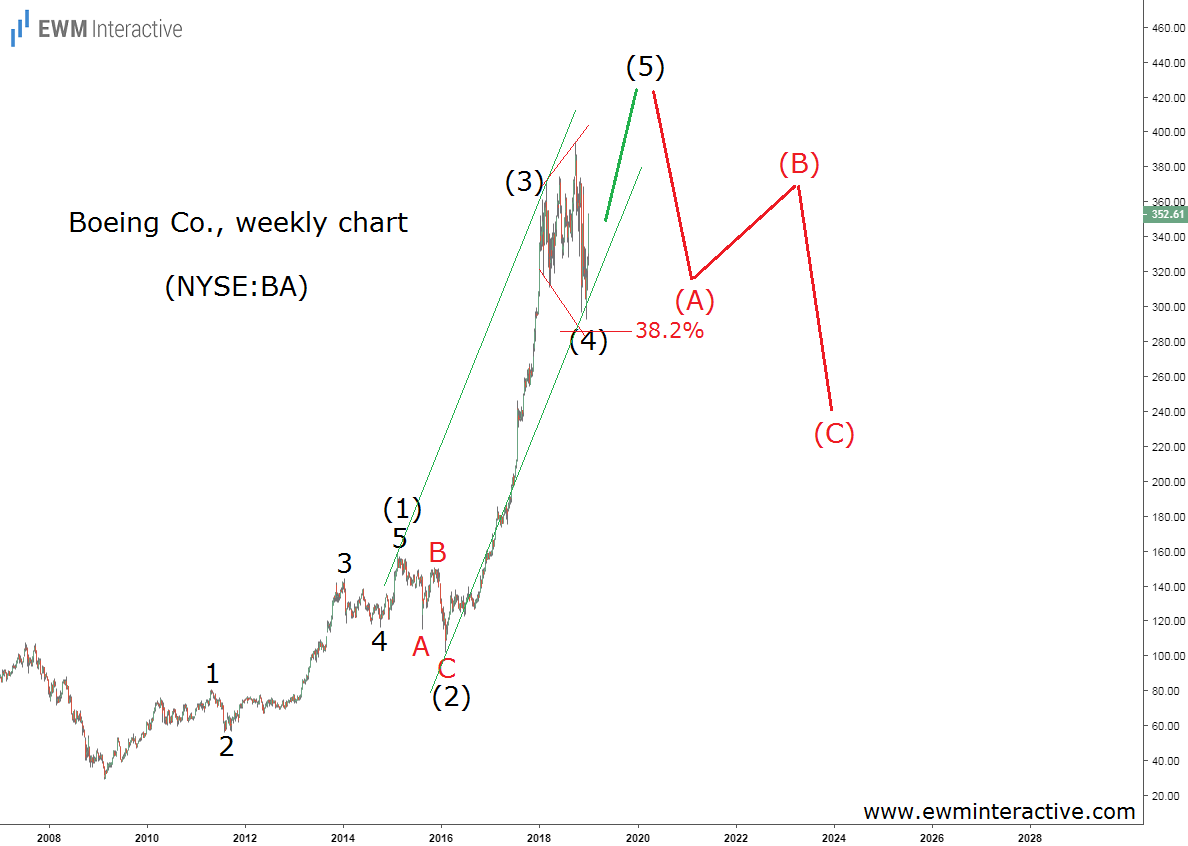

Boeing’s weekly chart put the stock’s entire uptrend since March 2009 into an Elliott Wave perspective. It revealed that a five-wave impulse has been in progress for the past 10 years. It was labeled (1)-(2)-(3)-(4)-(5), where the fifth wave was still unfolding.

Boeing (NYSE:BA) ‘s Unpredictable Crisis Led to a Predictable Selloff

The Elliott Wave theory states that every impulse is followed by a correction. So, we concluded that a new high can be expected, but “a bearish reversal near $450 can lead to a decline of 40% or more in the next 2-3 years.” We were obviously too conservative as Boeing (NYSE:BA) lost 40% in just 12 months. The updated chart below puts that drop in context.

The habit of the market is to anticipate, not to follow. It took ten years for Boeing (NYSE:BA) to draw its five-wave impulse pattern. The completion of that pattern meant the stage was already set for a decline. The market was anticipating it and was only waiting for a catalyst.

Then came the 737 MAX crisis. It was unpredictable and that’s the point. In the markets, relying on news and external events for guidance means you’re always one step behind.