There’s something few folks are talking about, but it’s something every investor needs to understand. We call it the “Yellen trap.” It could have huge ramifications for your wealth and, therefore, your financial liberty.

As Americans celebrate our Labor Day holiday, it’s only fitting that Wall Street spent Friday with its nose in the latest jobs report. The news was not great. The jobless rate fell, but fewer-than-expected jobs were created. But there’s something even more peculiar in the numbers. Something that points to a big problem.

Wage growth remains tauntingly slow. Most folks who follow these sorts of things know the Federal Reserve has two equally important (so it says) mandates: to keep inflation and employment just right. It’s the “Goldilocks” mandate.

Yellen doesn’t have a lot of tools. But the ones she does have are big and potent. Unfortunately, they’re increasingly powerless against a growing trend. America’s workforce is getting younger. And younger folks get paid less (sorry, newbies).

Our research shows that from 1980 through 2010, the median age of workers rose from 37.9 to 42.5 - about five years. But from 2010 to July of this year, it rose by a mere six months. It’s all thanks to the baby boomer generation - the oh-so-powerful “pig in the python.”

As the first wave of boomer retirees are clocking out for the last time, their jobs are being filled by younger, cheaper workers. The bean counters at JPMorgan tell us “that shifts in the age mix of workers added roughly 0.19% to year-over-year wage gains from 1981 to the end of 2010 and have subtracted roughly 0.06% from year-over-year wage gains since then.”

In other words, labor costs less.

That’s not great news for Yellen as she works to get wages rising before she pushes benchmark interest rates a notch higher. It’s a demographic trap.

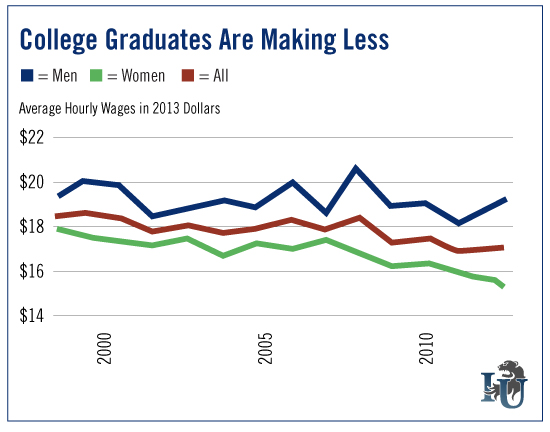

The chart below should scare you. It proves this trap is powerful and its jaws are sharp. It shows that the wages of recent college grads has solidly declined over the last 15 years. It’s just one powerful part of this game-changing trend.

The reason for the decline is easy to understand. The value of a college education is falling. Fast. As more and more folks feel a college education is a requisite for success, the value of a graduate wanes. These days, everybody has a degree - need it or not. Employers realize that a diploma has become a commodity so they pay less for them.

This is not a problem Yellen and her troops can wave a monetary magic wand at. It’s part of a huge demographic and cultural shift. It’s not much different from what we saw after Obama finally slashed the maximum time Americans could take unemployment benefits. When he made the move in 2013, some 1.3 million folks suddenly had to go back to work. With such a glut of labor prices fell.

Again, it’s not something Yellen can manipulate with interest rates or bond buying.

For investors, this demographic shift is critical to understand. It’s not something the talking heads are eager to tackle because it’s complicated. It’s hard to capture the idea in a catchy soundbite. That’s sad. It’s one of the biggest, most important trends we’ll see in our lifetimes. It means the once-mighty Federal Reserve has lost its power. The fact that it’s struggling to raise interest rates by a miserly quarter point - after more than six years - is all the evidence we need.

Yellen is trapped.

We’re not convinced this is bad news. Not at all. In fact, the trend is just one more reason we argue we’re living in a world without interest rates. It’s a land of incredible opportunity, but not in the traditional places.

Banks, insurers, pension funds... watch out. Specialty REITS, home builders, utilities... worth a look.

This demographic shift has trapped the Fed, no doubt. They’ll be fighting it for years. But as with all traps, if you know about it, you can keep your foot out of it.