Avnet Inc. (NYSE:AVT) is set to report fourth-quarter 2017 results on Aug 9. Last quarter, the company posted a positive earnings surprise of 2.33%. Let's see how things are shaping up for this announcement.

Factors at Play

Avnet has been taking major restructuring steps to primarily focus on the EM business. In doing so, the company completed the divesture of Technology Solutions business to Tech Data Corporation (NASDAQ:TECD) for approximately $2.645 billion.

The divestment of the Technology Solution division will allow Avnet to focus on high-growth areas such as marketing electronic components and related products in the supply chain. The company intends to use resources to make investments in embedded solutions, IoT and critical digital platforms as well as expand footprint in newer markets.

In Oct 2016, Avnet completed the much-awaited acquisition of Premier Farnell plc in a total cash deal worth approximately £691 million. U.K.-based Premier Farnell is engaged in the distribution of technology products and solutions, particularly engineering solutions to the electronic system design, maintenance and repair communities.

With its business spread across Europe, North America and Asia Pacific regions, the company operates in about 36 countries. The company believes that the acquisition will strengthen digital footprint worldwide.

In our opinion, the acquisition is strategically in sync with Avnet’s policy of focusing on high growth electronic component business.

Nonetheless, a significant portion of Avnet’s revenues comes from the sale of semiconductors, which is a cyclical industry, characterized by changes in technology and manufacturing capacity as well as subject to significant market upturns and downturns. Intensifying competition from Arrow Electronics Inc. also remains a headwind.

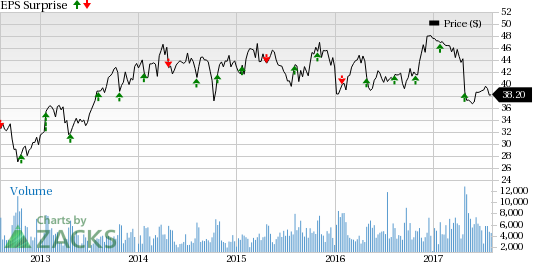

Avnet, Inc. Price and EPS Surprise

Earnings Whispers

Our proven model does not conclusively show that Avnetwill beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Avnet ESP is 0.00% since both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 77 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Avnet’ Zacks Rank #3 when combined with a 0.00% ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

Here are some companies you may want to consider as our model shows that they have the right combination of elements to post an earnings beat this quarter:

The Priceline Group Inc. (NASDAQ:PCLN) , with an Earnings ESP of +2.31% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sun Life Financial Inc. (TO:SLF) , with an Earnings ESP of +2.70% and a Zacks Rank #1.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

The Priceline Group Inc. (PCLN): Free Stock Analysis Report

Avnet, Inc. (AVT): Free Stock Analysis Report

Sun Life Financial Inc. (SLF): Free Stock Analysis Report

Tech Data Corporation (TECD): Free Stock Analysis Report

Original post

Zacks Investment Research