Vehicle rental & automobile leasing services provider, Avis Budget Group, Inc. (NASDAQ:CAR) , recently entered into a strategic partnership with Amazon.com, Inc. (NASDAQ:AMZN) to offer its customers car rental reservations services. Despite such an innovative endeavor, the news failed to evoke any positive investor response as shares traded relatively flat to close at $31.40 yesterday.

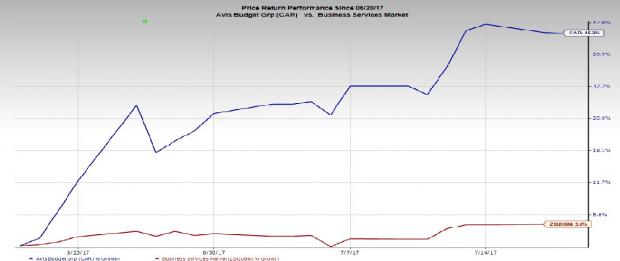

Over the last one month, shares of this Zacks Rank #3 (Hold) stock have returned 45.24%, outperforming the Zacks categorized Business - Services industry’s 3.81% gain, driven by some ingenious campaigns and collaboration with Waymo’s self-driving fleet.

Inside the Headlines

The deal would allow Avis to offer car rental reservation services through Amazon’s Echo devices simply by using an Alexa-enabled device. The offering is expected to be commercially available by the end of August.

This new feature makes Avis the first car rental services provider to allow passengers book and manage car reservations through an Amazon Echo device. This feature also allows customers to track their reservation history, as well as enable them to request e-receipts.

The collaboration would allow Avis to tap increasing communication between users and virtual assistants. As per Gartner, Inc (NYSE:IT) , by 2018, almost one-third of consumer interactions with technology are going to be through voice assistance platforms. Avis already has an Android application that enables customers to make, confirm or cancel bookings through voice commands. The integration with Amazon Alexa would allow Avis to support its exploration of online and mobile portals program by creating an advanced reservation and rental experience for its customers. This is likely to generate incremental revenues for Avis as more customers use this convenient feature for car rental services.

Stock to Consider

A better-ranked stock in the industry is Healthcare Services Group, Inc. (NASDAQ:HCSG) that currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Healthcare Services Group has a long-term earnings growth expectation of 14.5%. It topped earnings estimates twice in the trailing four quarters with a positive surprise of 1.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Avis Budget Group, Inc. (CAR): Free Stock Analysis Report

Healthcare Services Group, Inc. (HCSG): Free Stock Analysis Report

Gartner, Inc. (IT): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Original post

Zacks Investment Research