Media production products, tools, and services provider Avid Technology (NASDAQ:AVID) is undergoing an amazing digital transformation and turnaround to adapt to the digital winds of change. The legacy provider of studio-level video and audio products for motion picture development has staged a sharp turnaround to embrace the digital migration in the entertainment industry.

Kudos must be given to the Company for staying on the cutting edge as the professional’s choice for broadcast, motion picture and live events production tools. from re-opening tailwinds. The Company is adopting both cloud and subscription-based models to broaden its reach and depth as well as provide cash flow predictability to further establish itself as a leader in developing, editing, production and post-production professional digital content creation tools.

The digital streaming and content wars are driving the demand for video and audio content creation tools. This is will continue to be a growth driver that offsets its legacy studio hardware and perpetual licensing model. The Company stands to benefit from the insatiable demand for professional-quality video content. Prudent investors looking for a winner in the streaming wars can watch shares of Avid Technology for opportunistic pullbacks to consider accumulating a position.

Q4 Fiscal 2020 Earnings Release

On Mar. 9, 2021, Avid reported its fiscal Q4 2020 results for the quarter ending December 2020. The Company reported earnings-per-share (EPS) of $0.33 versus consensus analyst estimates for $0.32, a $0.01 beat. Revenues fell (-10.32%) year-over-year (YoY) to $104.30 million, matching analyst estimates. Subscriptions revenues rose 54.9% YoY to $24.5 million. Paid Cloud-enabled software subscriptions rose 57.8% YoY to 296,000, up 27,000 in Q4. Subscription and maintenance revenue ruse 12.7% YoY to $55.5 million. Total revenues rose 15.3% sequentially from Q3 2020.

The Company generated $20.7 net cash from operations in Q4 and $30.6 million free cash flow, up $13.7 million in prior year ago period. AVID CEO Jeff Rosica stated:

“The growth in our Recurring Revenue business was driven primarily by the continued expansion in our subscription revenues, which have now experienced a second stage of growth as we had several enterprise customers adopt subscription plans during the quarter…. We also some strong fourth quarter bookings and billings performance that helped drive a stronger opening Revenue Backlog for 2021... As our customers adjust their business models, we believe they will continue to invest in value-added technology and that we are well-positioned to meet these needs for them.”

Conference Call Takeaways

CEO Rosica set the tone:

“Overall, we’re quite pleased with our progress and our execution through the difficult environment in 2020. Driven by our ongoing transition to a subscription-focused business and our focus on profitability, this year we turned the corner to being a growing free cash flow story.”

CEO Rosica is confident in the industry’s “eventual recovery” as the business normalizes, and companies adopt to more distributed and flexible workforces. The combination of subscription revenue and maintenance revenue growth resulted in higher annual contract values. The Company added over 108,000 new paid subscriptions to its Pro Tools, Media Composer, and Sibelius tools in 2020. Enterprise customers are embracing the benefits of subscription-based offerings, notably with its MediaCentral enterprise solutions.

The recovery was notable starting in Q3 2020 as the Company expects growth to continue through 2021, “as creative professionals adopt our solutions and are able to create high-quality video and audio content using our creative tools.” The Company came into 2021 with $18 million in cost savings that will continue into the new year. Recurring revenue rose to 74% of total revenues, up from 62% in 2019. Annual contract values (ACV) rose 7.4% YoY in 2020.

Freemium Pipeline

Avid is a key player not just with studios, but individual content creators. The insatiable demand for new video content spans not just streaming platforms but all throughout social media platforms like YouTube where high quality content is monetized by creators. The pivot to offer “freemium” access to basic features has opened up it’s audience reach to compel and convert new users among amateur content creators on up to enterprise level film and commercial television producers. This is a part of the “new normal” with re-openings as consumers spend more time on independent streaming services and social media channels they may have stumbled upon during the pandemic, which will prove to be more “sticky” than analyst may assume.

AVID Opportunistic Pullback Levels

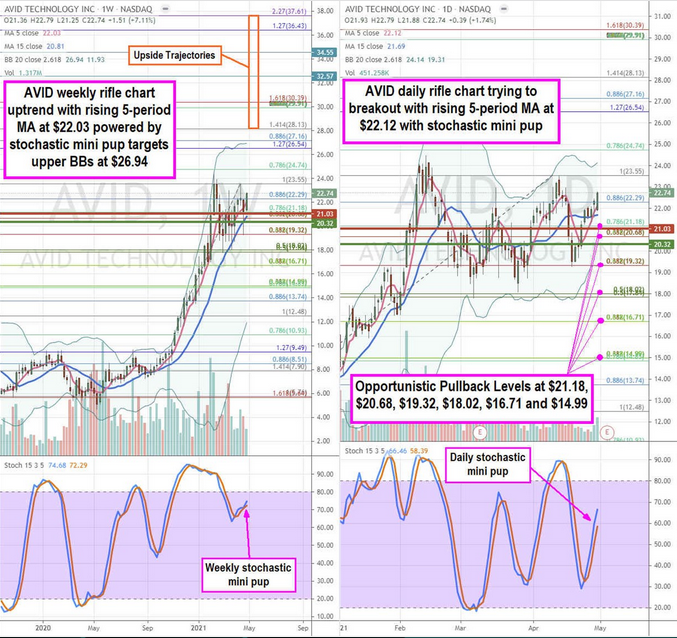

Using the rifle charts on the weekly and daily time frames provide a precision view of the landscape for AVID stock. The weekly rifle chart has an active pup breakout with a rising 5-period moving average (MA) support at $22.03 as the stochastic tries to power higher with a mini pup through the $22.29 Fibonacci (fib) level. The weekly market structure high (MSH) sell trigger forms on a breakdown under $21.03. The daily rifle chart is attempting to for a breakout as the 5-period MA at $22.12 crosses over the 15-period MA at $21.69.

The daily market structure low (MSL) buy triggered on the breakout through $20.32 as the daily stochastic attempts to for a mini pup towards the upper Bollinger Bands (BBs) at $24.14. on the breakout above $17.86, while a weekly market structure high (MSH) triggers below $15.79. Prudent investors can monitor for opportunistic pullback levels at the $21.18 fib, $20.68 fib, $19.32 fib, $18.02 fib, $16.71 fib, and the $14.99 fib. Upside trajectories range from the $28.13 fib up to the $37.61 fib level.