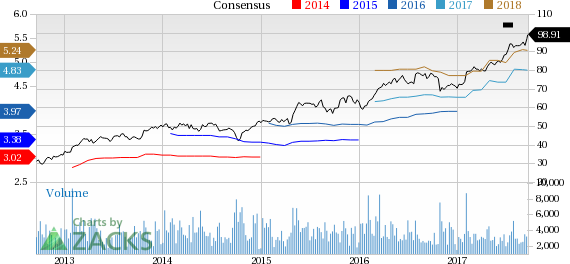

Shares of Avery Dennison Corporation (NYSE:AVY) scaled a 52-week high of $99.26 on Sep 18, eventually closing nominally lower at $98.91.

Avery Dennison has a market cap of $8.7 billion. Average volume of shares traded over the last three months is approximately 636.5K. We note that the company has beaten the Zacks Consensus Estimate in each of the trailing four quarters, the average positive earnings surprise being 6.07%.

Notably, the stock gained 27.4% over a year, higher than the S&P 500’s gain of 17% during the same time frame. Avery Dennison has also outperformed the industry’s gain in a year’s time with respect to share price movement. Shares of the company have gained 27.4%, while the industry registered 24.8% growth.

Further, Avery Dennison carries a Zacks Rank #2 (Buy). The company has an impressive Growth Style Score of A. Our Growth Style Score highlights all the vital metrics of a company’s financials to obtain a clearer picture of the quality and sustainability of its growth. Our research shows that stocks with Style Scores of A or B, when combined with a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold), offer the best investment opportunities.

What's Driving Avery Dennison?

The share price momentum can primarily be attributed to Avery Dennison’s cost-reduction activities and focus on consistent execution of strategies. These factors drove the company’s second-quarter adjusted earnings per share which surged 20% year over year. Also, its revenues jumped around 5.5%. Both the figures beat the Zacks Consensus Estimate.

For 2017, Avery Dennison raised its adjusted earnings per share guidance range and expects it between $4.75 and $4.90, backed by robust operating outlook and lower full-year tax rate. The company anticipates sales growth to be between 7% and 8% for the full year, reflecting the impact of the Yongle and Finesse acquisitions and a smaller currency headwind.

Avery Dennison’s aggressive cost cutting and restructuring as part of the current optimization program will likely lead to improved savings and boost earnings. The company expects restructuring savings to be $45-$50 million in 2017.

Moreover, the company’s consistent execution of strategies continues to enhance competitive advantage, while driving profitable growth and improving returns.

All these measures probably raised investors’ confidence and are anticipated to boost the company’s share price in the days ahead.

In addition, positive estimate revisions reflect optimism in the company’s potential, as earnings growth is often an indication of robust prospects (and stock price gains) ahead. Estimates for Avery Dennison have moved up in the past 60 days, reflecting analysts’ bullish outlook. The earnings estimate for 2017 has gone up 4.8%, while that of 2018 moved up 5%. Further, the company’s long-term earnings growth rate of 7% holds promise.

Other Key Picks

Other top-ranked stocks in the same sector are AGCO Corp. (NYSE:AGCO) , Terex Corp. (NYSE:TEX) and EnPro Industries, Inc. (NYSE:NPO) . All three stocks flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an expected long-term earnings growth rate of 13.5%.

Terex has an expected long-term earnings growth rate of 19.7%.

EnPro Industries has an expected long-term earnings growth rate of 15.9%.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Terex Corporation (TEX): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

EnPro Industries (NPO): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Original post

Zacks Investment Research