The producer of pressure-sensitive and functional materials and labeling solutions for the retail apparel market, Avery Dennison Corporation (NYSE:AVY) , is set to release second-quarter 2017 results on Jul 25, before the market opens.

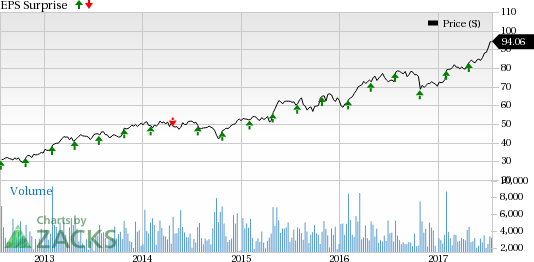

The company’s financial performance over the last four quarters was impressive, witnessing better-than-expected results in each. Average earnings surprise was a positive 5.53%. Notably, in the last quarter, the company’s earnings of $1.11 per share topped the Zacks Consensus Estimate by 6.73%.

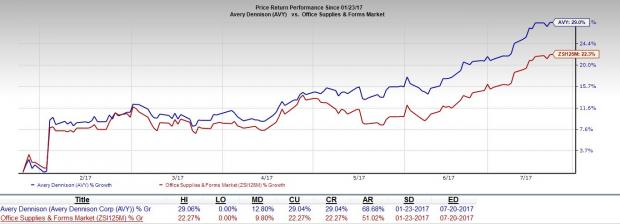

We believe that its constant focus on execution of strategies, sound financial performance and growth opportunities have lifted investor sentiments for Avery Dennison. In the last six months, the company’s shares have yielded 29% return, outperforming growth of 22.3% recorded by industry it belongs to.

Let us see whether Avery Dennison will be able to maintain its earnings streak this quarter.

Why a Likely Positive Surprise?

Our proven model shows that Avery Dennison is likely to beat estimates in the second quarter. This is because the company has the combination of two key ingredients for a possible earnings beat – a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold).

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Avery Dennison has an ESP of +1.68%, with the Most Accurate estimate of $1.21 exceeding the Zacks Consensus Estimate of $1.19.

Zacks Rank: Avery Dennison’ Zacks Rank #2 increases the predictive power of ESP. Moreover, its positive ESP makes us reasonably confident of an earnings beat.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sellrated) going into the earnings announcement, especially when the company is seeing a negative estimate revisions momentum.

What’s Driving the Better-than-Expected Earnings?

Avery Dennison’s execution of strategies continues to enhance its competitive advantage, while driving profitable growth and improving returns. The company’s effort to reduce complexity, focus on cost structure, and use of lower-cost locally sourced materials that will support more competitive pricing, will boost its margin performance in the quarter to be reported.

Though Avery Dennison anticipates some sequential raw material inflation in second-quarter 2017, consistent focus on productivity will drive results.

Stocks That Warrant a Look

Here are some stocks you may want to consider, as according to our model they have the right combination of elements to post an earnings beat this quarter.

Belden Inc. (NYSE:BDC) , with an Earnings ESP of +0.83% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

AptarGroup, Inc. (NYSE:ATR) , with an Earnings ESP of +1.03% and a Zacks Rank #2.

Sealed Air Corporation (NYSE:SEE) , with an Earnings ESP of +2.78% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Belden Inc (BDC): Free Stock Analysis Report

Sealed Air Corporation (SEE): Free Stock Analysis Report

AptarGroup, Inc. (ATR): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Original post

Zacks Investment Research