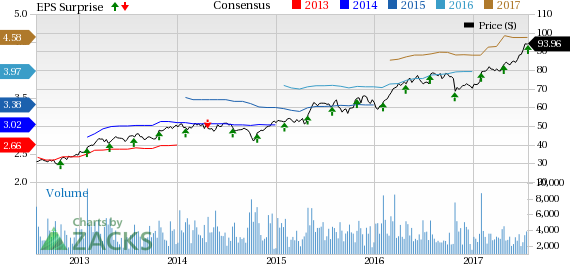

Avery Dennison Corporation (NYSE:AVY) reported adjusted earnings of $1.31 per share in second-quarter 2017, up 20% from $1.09 recorded in the year-ago quarter. Earnings also beat the Zacks Consensus Estimate of $1.19.

Including restructuring costs and other items, earnings from continuing operations came in at $1.34 per share in the quarter compared with 88 cents recorded in the prior-year quarter.

Total revenue jumped around 5.5% to $1,627 million from $1,541.5 million in the year-earlier quarter. Moreover, revenues surpassed the Zacks Consensus Estimate of $1,601 million. On an organic basis, sales were up nearly 2.9% year over year.

Cost of sales in the reported quarter went up 6% year over year to $1,174 million. Gross profit increased around 4% to $452.6 million, while gross margin contracted 20 basis points (bps) to 27.8%.

Marketing, general and administrative expenses came in at $276.7 million compared with $269.2 million incurred in the year-ago quarter. Adjusted operating profit advanced 6.7% year over year to $175.9 million. Adjusted operating margin expanded 10 bps on a year-over-year basis to 10.8%.

Segmental Performance

Revenues from the Label and Graphic Materials segment climbed 5.5% year over year to $1,123 million. On an organic basis, sales grew around 2.3%. Adjusted operating profit rose 5.9% to $153 million from $144.5 million in the year-ago quarter.

Revenues from the Retail Branding and Information Solutions segment grew 4.6% to $375 million from $358.5 million recorded in the year-earlier quarter. Organic sales increased 5.8%. The segment’s adjusted operating income surged 21.6% to $31 million.

The Industrial and Healthcare Materials segment reported net sales of $128.7 million, up 8.7% from $118.4 million recorded in the prior-year quarter. The segment reported adjusted operating income of $13.4 million compared to an operating profit of $17.1 million recorded in the year-ago period.

Financial Updates

Avery Dennison generated cash and cash equivalents of $209.4 million at the end of second-quarter 2017 compared with $216 million recorded at the end of the prior-year quarter. Cash flow from operations came in at $178.3 million during the six-month period ended Jul 1, 2017, compared to $216 million in the comparable period last year.

At the end of second-quarter 2017, Avery Dennison’s long-term debt increased to $1,276 million compared with $962.9 million at the end of the prior-year quarter.

During the reported quarter, Avery Dennison repurchased 0.4 million shares for a total cost of $36 million. The company’s share count increased 0.5 million in the reported quarter. The cost of repurchases, net of proceeds from stock option exercises, is $35 million.

Cost-Reduction Activities

In the second quarter, Avery Dennison realized approximately $15 million in pre-tax savings from restructuring. The company incurred restructuring charges of approximately $8 million.

Guidance

For 2017, Avery Dennison raised its adjusted earnings per share guidance range to $4.75–$4.90 from the prior band of $4.50–$4.65, on the back of continued strong operating performance and a reduction in tax rate. The company remains confident about the consistent execution of strategies which will help achieve long-term goals for superior value creation, while driving profitable growth and improving returns.

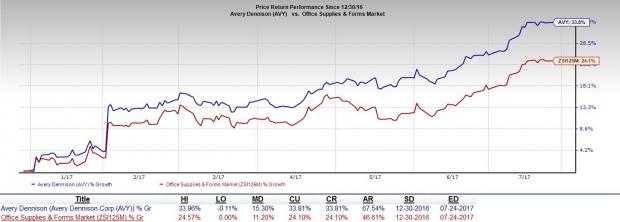

Share Price Performance

Year to date, Avery Dennison has outperformed its industry with respect to price performance. The stock gained 33.8%, while the industry recorded growth of 24.1% over the same time frame.

Zacks Rank & Other Key Picks

Currently, Avery Dennison carries a Zacks Rank #2 (Buy).

Other top-ranked companies in the same sector are AGCO Corporation (NYSE:AGCO) , Apogee Enterprises, Inc. (NASDAQ:APOG) and Cimpress N.V. (NASDAQ:CMPR) , all three sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has expected long-term growth rate of 12.41%.

Apogee has expected long-term growth rate of 12.50%.

Cimpress has expected long-term growth rate of 17.50%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Apogee Enterprises, Inc. (APOG): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Cimpress N.V (CMPR): Free Stock Analysis Report

Original post