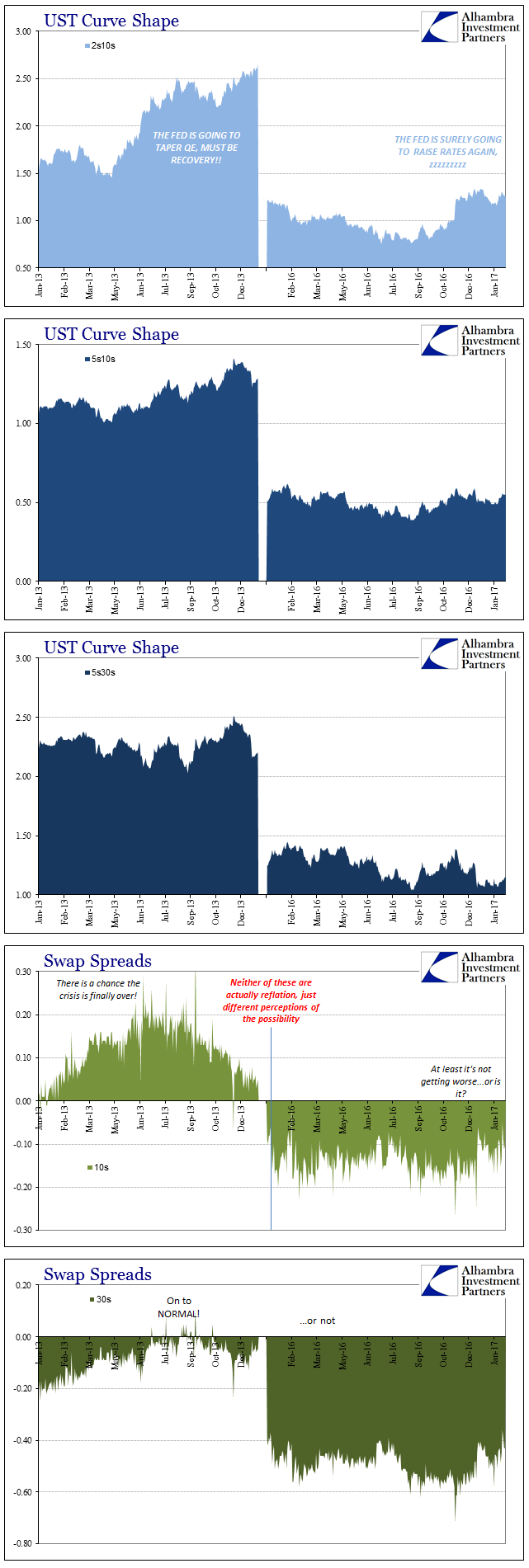

In the aftermath of the “rate hike” in December, there was a rush to quantify, as far as expectations of political considerations may be attainable in such format, just how much the Fed would further “hike” in 2017 as a distillation of how good they figured the economy to be. As overall “reflation”, however, that was more of a media construct than a market one. Markets, as is absolutely clear, don’t seem to be too bothered by what the Fed thinks one way or another.

The mainstream may or may not remember, but the bond market surely does that the Fed expected to hike at least four and maybe six times in 2016 – it did just the one. Economic assessment is not a strength of the central bank, an all-too-constant feature spanning the distance of this lost decade. As noted Monday, internal policy discussions are far less assured, as it is only the language of external statements that seem brushed with confidence.

MR. WILCOX. We’ve been marching determinedly in a negative direction. John Stevens had a nice exhibit in yesterday’s Board briefing that showed just how much we’d taken the forecast down over the course of this year. Also, I want to just emphasize that I think the gaps in our understanding of the interactions between the financial sector and the real sector are profound, and they have, over the past few years, deeply affected our ability to anticipate how the real economy would respond, and they are continuing to do so now. [emphasis added]

I wrote in September 2015, back when “everyone” was sure the Fed was going to start a Greenspan-like regime:

Two members in December 2013 were expecting the federal funds rate by the end of 2015 to be 2.75% or more. By March, more than half the members (10) were expecting 1% or higher for this year, including three at 2% or higher. All but two predicted at least one rate hike. In short, overheating never was, which, again, as a major nonconformity marks a truly a serious problem. Everything that has happened with regard to monetary policy has been to explain how this could happen while simultaneously trying to claim nothing has happened. [emphasis added]

And that last sentence is, I believe, why the markets no longer really care, especially as it relates to Mr. Wilcox’s statement from 2011 that might be news only to the news media. Minor progress, perhaps, but progress all the same.