Avalon (AVL) intends to capitalise on its early mover advantage and develop its heavy rare earth element (HREE) enriched Nechalacho deposit in the Northwest Territories, Canada. It has made significant moves to create strong relationships with future off-take partners, helped in part by strict adherence to its Corporate Sustainability Report, a key differentiator. With demand continuing to outstrip supply globally for valuable heavy rare earths, Avalon’s HREE enriched project is an attractive opportunity to enter the REE space with lower technical risk than many of its peers. We value Avalon on the basis of its April 2013 feasibility study (FS), which results in a value of C$5.44/share (at a 10% discount rate, fully diluted, with a 30% equity sell down for funding). To this should be added C$0.15/share for the value of its current cash balance of C$16m for a total valuation of C$5.59 per share.

First major separation plant outside China planned

Avalon intends to separate out the majority of the most valuable REEs into individual rare earth oxides at a current capex estimate of c C$423m for the separation plant and associated infrastructure in Louisiana, US (included in the total of US$1,453m). This is an important factor considering the lack of any significant capacity to separate REEs outside of China. A separation plant outside China represents a key de-risking factor for end-users that want to reduce their exposure to Chinese supply and aids Avalon’s objective to establish and maintain market share commensurate with its planned production capacity.

Corporate Sustainability Report a key differentiator

Avalon’s Corporate Sustainability Report allows off-take partners of Avalon’s future products to audit their supply chains, which is significant when corporate identity and reputation are as important as securing cheap raw materials and stable supply.

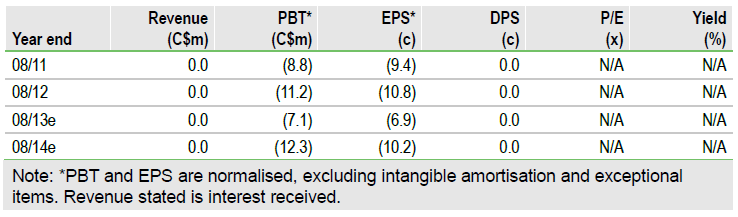

Valuation: Shares at 66% discount

Our valuation considers first production at Nechalacho in late-2016, with first cash flows in 2017 and reaching steady state production in 2018. In the light of recent decreases in rare earth and Nechalacho’s other end-product prices, we use conservative pricings (supplied by Avalon due to the opacity of these commodity markets), which results in a dividend discount valuation of C$5.44 per share (at a 10% discount rate and fully diluted). To this should be added C$0.15/share for the value of its current cash balance of C$16m for a total valuation of C$5.59 per share.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Avalon Rare Metals: Shares Now At 66% Discount

Published 05/20/2013, 07:17 AM

Updated 07/09/2023, 06:31 AM

Avalon Rare Metals: Shares Now At 66% Discount

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.