Federal government approves Nechalacho

Avalon Rare Metals Inc, (AVL) has announced it received federal government approval for its report of environmental assessment for its flagship heavy rare earth element-enriched Nechalacho deposit in the Northwest Territories, Canada. Approval was granted on 4 November by the Minister for Aboriginal Affairs and Northern Development Canada. This follows the Mackenzie Valley Environmental Impact Review Board’s positive recommendation in July 2013. Having reached this significant milestone, Avalon now has a better defined path to obtaining all remaining operating permits, and ultimately to arrange for financing the C$1.5bn price tag to achieve first revenues from Nechalacho in 2017.

Land use permits and water licence next

With approval from the federal government for its report of environmental assessment, Avalon can now proceed with formal applications for the required land use permits and water licences from the Mackenzie Valley Land and Water Board.

Shelf prospectus filed – ready for equity financing

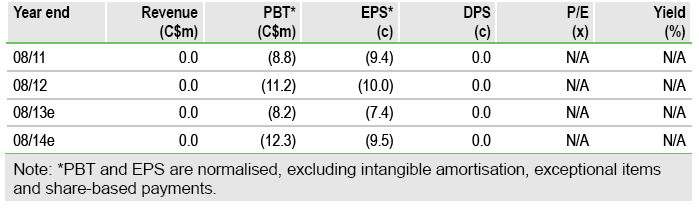

On 12 September 2013 Avalon lodged a final base shelf prospectus, under which it would be able to issue shares, warrants or a combination of both for proceeds of up to US$500m. For now we continue to model Nechalacho being financed with a mix of 70% debt and 30% equity. We currently only forecast C$35m in equity raised at a notional C$1.00/share (see our May 2013 Outlook note).

Valuation: Reiterated until financing is clarified

We retain our base-case valuation given in our May 2013 Outlook note. This considers commissioning at Nechalacho in 2016 (which could still be achieved in light of this current federal project approval), with first cash flows in 2017 and reaching steady state production in 2018. The valuation is based on Avalon’s April 2013 feasibility study and on conservative commodity price inputs reflecting current levels provided by Avalon. On this basis, we value Avalon’s shares at C$5.44 (fully diluted using a C$1.00 share price and using a 10% discount rate), to which C$0.09 should be added for the value of its current cash, for a total valuation of C$5.53 per share. In our model we assume the equity component is sold to a strategic partner.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Avalon Rare Metals: Land Use Permits And Water Licence Next

Published 11/07/2013, 05:19 AM

Updated 07/09/2023, 06:31 AM

Avalon Rare Metals: Land Use Permits And Water Licence Next

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.