AutoZone, Inc. (NYSE:AZO) will report fiscal fourth-quarter earnings ahead of the open tomorrow, Sept. 18. The do-it-yourself car repair retail stock has been fairly quiet on the charts in the month leading up to tomorrow's report, as evidenced by its 30-day historical volatility of 15.4%, which ranks in the 9th annual percentile. Nevertheless, options traders are anticipating a larger-than-usual post-earnings swing for AZO stock.

Most recently, data from Trade-Alert pegs the implied daily earnings move at 8% for AZO stock, higher than the post-earnings next-day swing of 4.9% the stock has averaged over the last two years. These earnings reactions have mostly been to the downside, including the two most recent. Of those eight results, just three were large enough to exceed the move expected for tomorrow's trading -- a 9.5% drop in May, an 11.1% plunge in February, and an 11.8% slide in May 2017.

Drilling down on recent options activity points to a slightly heavier-than-usual bullish tilt. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), AutoZone's 10-day call/put volume ratio of 1.03 ranks in the 65th annual percentile.

Meanwhile, the 30-day at-the-money implied volatility (IV) for AZO is at 30.9%, which ranks in the 73rd annual percentile -- indicating short-term options are pricing in higher-than-normal volatility expectations. Plus, the 30-day IV skew of 2.8% registers in the 10th percentile of its 12-month range, meaning short-term calls have rarely been more expensive than puts, from a volatility perspective.

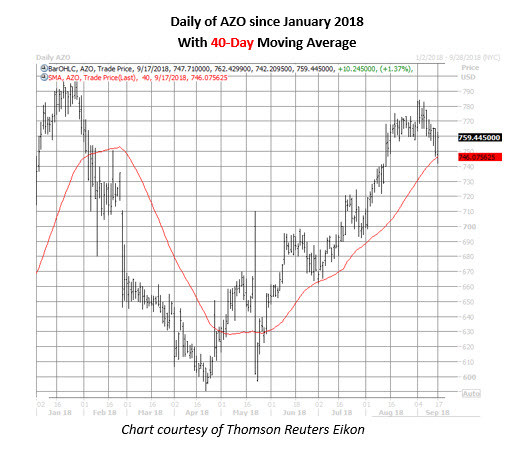

Looking at the charts, AZO shares have been in a channel of higher highs and lows since hitting a year-to-date low of $590.76 in late April. More recently, the stock's pullback from its early September seven-month high of $784 was quickly contained by its 40-day moving average -- which served as support back in July -- with AutoZone last seen trading up 1.1% at $756.98.