Automobile stocks are still the place to be, just not the ones you think. Ford, (F) and General Motors,(GM), still have a lot of ugliness in their charts. So turn your sights to a different perspective on them. The makers of automotive systems are looking great. Below is a look at two of them, BorgWarner, (BWA) and Magna International, (MGA).

BorgWarner, (BWA) has had a wonderful trend higher that was spoiled recently by a pullback in a channel. It is now testing the top of that channel though, and has had some great indicator readings to support a break higher. The Relative Strength Index (RSI) is moving up, and making a higher high as the MACD is starting to curl higher and prepare for a bullish cross. Finally the accumulation/distribution statistic shows that there were buyer all through the pullback and they are getting more aggressive. A move over the channel at 53.75 triggers a long entry.

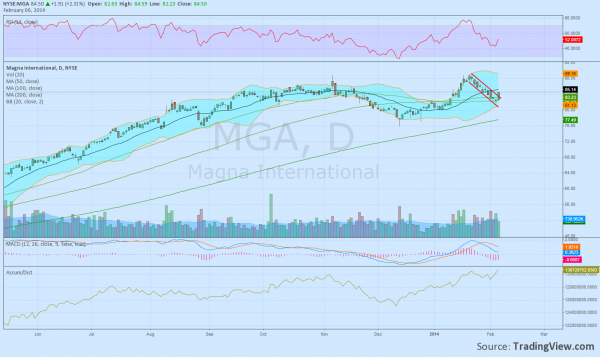

Magna International, (MGA), is similar. It had a pullback in a rounded bottom through December and then again recently in a channel. Thursday it broke the channel higher though. It has the same characteristics as BorgWarner from the technical indicators. The RSI is moving higher, the MACD is level and ready to turn higher, and the Accumulation/distribution statistic is making new highs. This is ripe for a trade or more against a stop at about 81.50.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.