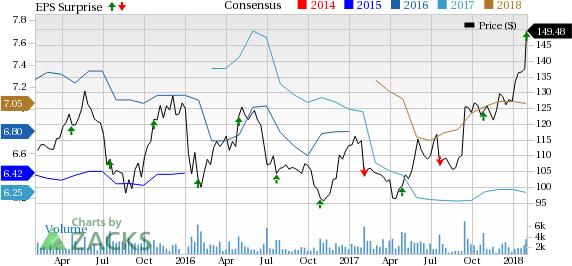

Autoliv, Inc. (NYSE:ALV) reported adjusted earnings of $2.03 per share in fourth-quarter 2017, beating the Zacks Consensus Estimate of $1.74. Also, the bottom line came in 18.7% higher than the prior-year quarter figure.

During the quarter, Autoliv reported net sales of $2.73 billion, reflecting an increase of 4.8% year over year. Also, the top line came in higher than the Zacks Consensus Estimate of $2.69 billion.

Operating income plunged 94.7% to $12.6 million. Adjusted operating margin was 9.6% in the reported quarter, higher than the prior-year quarter figure of 9.3%.

For full-year 2017, adjusted earnings came in at $6.58 per share, decreasing 2.5% from 2016. The Zacks Consensus Estimate for adjusted earnings for 2017 was $6.25 per share. During the year, Autoliv reported net sales of $10.4 billion, reflecting an increase of 3.1% from the 2016 figure. The Zacks Consensus Estimate for 2017 net sales was $10.4 billion.

Segment Results

Sales at the Passive Safety segment increased 6.1% year over year to $2.16 billion in the reported quarter. Excluding positive currency translation effects, organic sales increased 2%. The segment’s operating income increased 13.3% to $258.8 million year over year.

Sales at the Electronics segment increased 1.5% year over year to $593.1 million. Operating loss at the Electronics segment was $213.1 million against operating income of $29.8 million in the prior-year quarter.

Financial Position

Autoliv had cash and cash equivalents of $959.5 million as of Dec 31, 2017, lower than $1.23 billion reported as of Dec 31, 2016. Long-term debt was $1.32 billion as of Dec 31, 2017, almost unchanged from the Dec 31, 2016 figure.

In fourth-quarter 2017, the company’s cash flow from operations rose to $389.4 million from the year-ago figure of $294.2 million. Net capital expenditures increased to $167.8 million from the year-ago figure of $159.1 million.

Dividend

On Dec 12, 2017, Autoliv announced quarterly dividend of 60 cents per share for the first quarter of 2018, unchanged sequentially. The dividend will be paid on Mar 8, to shareholders on record as of Feb 22.

Guidance

In first-quarter 2018, Autoliv expects organic sales of less than 1% compared with first-quarter 2017 figure. Currency translations are expected to have a positive impact of more than 6% on sales, leading to consolidated sales growth of more than 7%. Adjusted operating margin in the first quarter is likely to be around 9%.

Autoliv expects full-year 2018 organic sales to be more than 7%. The currency translation is expected have a positive impact of around 4% on sales. Based on these factors, consolidated sales are expected to increase more than 11%.

Tax rate for full-year 2018 is likely to be around 29%.

Autoliv carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the auto space are Oshkosh Corporation (NYSE:OSK) , Daimler A.G. (OTC:DDAIF) and Allison Transmission Holding, Inc. (NYSE:ALSN) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Oshkosh has an expected long-term growth rate of 14.5%. Shares of the company have gained 34.6% in the last six months.

Daimler has an expected long-term growth rate of 2.8%. In the last six months, shares of the company have returned 31%.

Allison Transmission has an expected long-term growth rate of 10%. Shares of the company have increased 19.3% in the last six months.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Daimler AG (DE:DAIGn) (DDAIF): Free Stock Analysis Report

Autoliv, Inc. (ALV): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Oshkosh Corporation (OSK): Free Stock Analysis Report

Original post

Zacks Investment Research