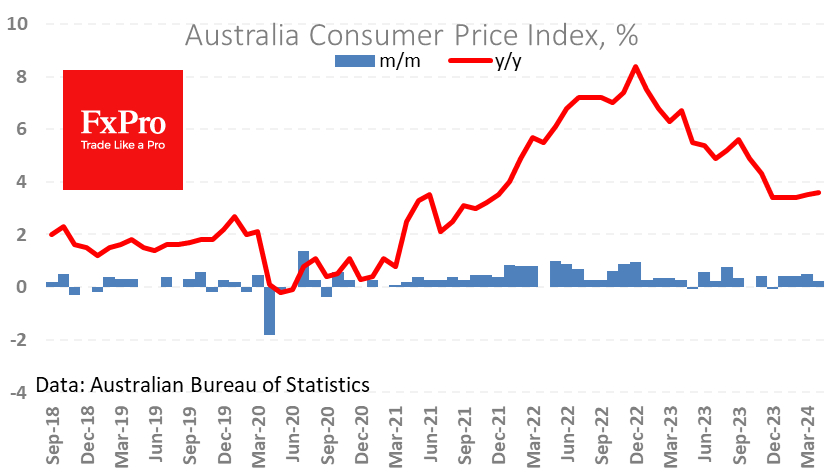

Consumer inflation in Australia rose in April, contrary to the expected decline. Year-on-year price gains totaled 3.6% vs. 3.5% previously and average forecasts of a decline to 3.4%.

The inflation rate reached a plateau late last year, falling to 3.4%, but has been ticking upward for the past two months. Prices have added ten months out of the past 12. Their rise over the past four consecutive months removes the question of an imminent rate cut.

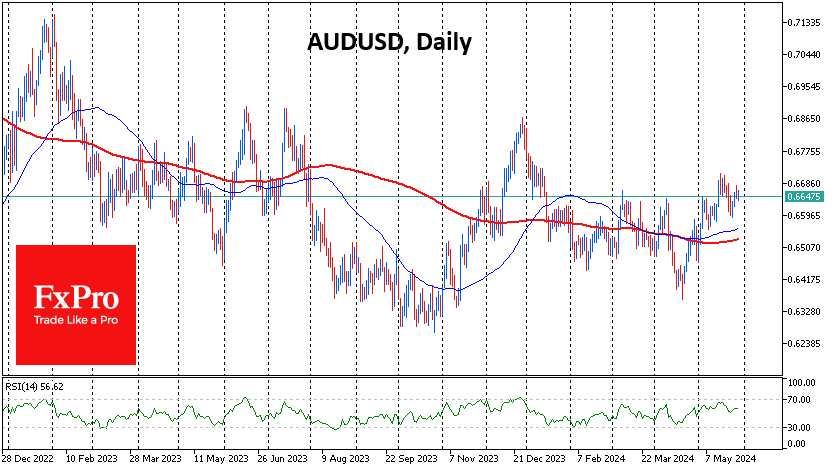

Judging by the reaction of the currency market, traders are not laying down for a policy tightening. AUD/USD is facing stronger selling on attempts to rise above 0.6650. This is an interesting development, given the rise in industrial metals prices and some recovery in trade with China in recent months.

The Australian currency's ability to break the multi-month resistance at 0.6650 would open the way to 0.6800, the pivot area of the past 12 months. The current currency market slack, alongside potentially bullish data, is also helping to create domestic pressure.

On the bears' side, however, is the weakness in retail sales, which saw a 0.1% m/m and 1.3% y/y rise in April.

The FxPro Analyst Team