Key Points:

- Australian unemployment rate declines to 5.7%.

- Part time employment numbers rising.

- Watch for the RBA to hold rates steady at the next meeting.

The latest release of Australian Unemployment data has largely caught economists, and by extension the market, sharply by surprise. In fact, rather than coming in at the forecasted 5.9% the unemployment rate actually declined to 5.7% in April. Subsequently, the labour market appears to be going through resurgence but just how robust the current gains are remains to be seen.

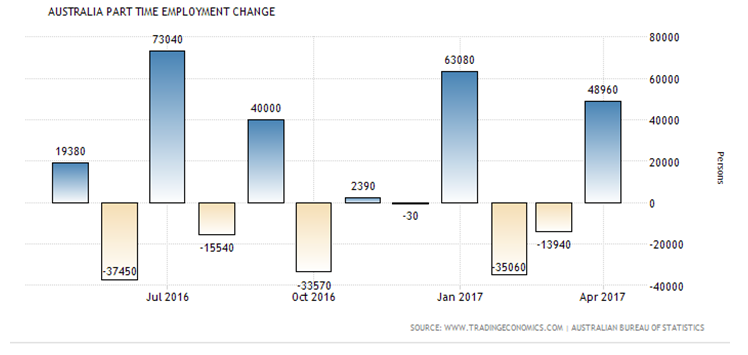

The employment change figures for April showed a gain of around 37.4k jobs, which followed on from a rise of 60k in March. Obviously, this is a welcome strengthening of the labour market and should lead to some inflationary gains over the medium term. However, the headline rate was a little less impressive with full time positions declining by nearly 11.6k in April. Subsequently, the rise in part-time employment is a relatively concerning trend in the Australian economy.

In fact, the total hours worked metric declined by around 0.3% whilst part time employment has risen by over 111,300 positions in the past year. This all highlights the underlying reasons why the unemployment rate and job gain figures can be somewhat misleading. It also goes some of the way to explaining why there has been little in the way of systemic inflation over the past year, despite some strong gains in the employment numbers.

However, despite the employment figures being somewhat unreliable as an macroeconomic indicator, the results are likely to be noticed by the Reserve Bank of Australia (RBA). In fact, there is a view that the recent gains may actually see the central bank delaying a potential cut to interest rates given the risk of inflationary pressures arriving down the line.

Subsequently, the next RBA meeting is likely to see the central bank holding rates at 1.50% for the tenth consecutive meeting. Lending further support to this view is the increasing domestic debt levels, largely to do with the housing bubble, that the central bank are very clearly concerned with. Subsequently, cutting rates further, and by extension, providing a looser credit environment is likely to not be particularly high on the RBA’s agenda.

Ultimately, although the falling unemployment rate is likely to be relatively welcome news to the Australian public. It hides deeper issues around the appropriateness of part time employment and what impact this will have on inflation in the medium term. Subsequently, don’t expect any action from the RBA at the next meeting as the central bank will, again, sit on their hands.