Key Points:

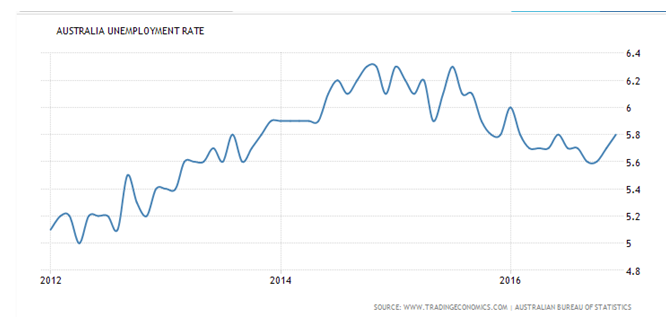

- Australian Unemployment Rate rises to 5.8%

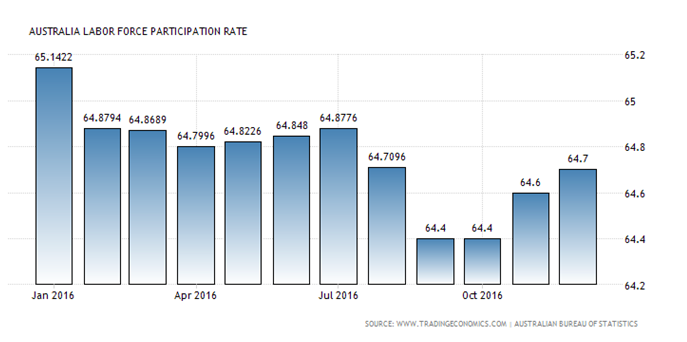

- Increase largely explained by rise in participation rate.

- Shadow statistics hint at larger labour market fragility.

The Australian economy took another hit Wednesday night as the latest round of Unemployment Rate data suggested that the benchmark rose to 5.8%, the third consecutive monthly rise. Subsequently, many are now questioning the fragility of the labour market despite December showing a 13,500 net gain in jobs.

In addition, the recent job gains have been relatively concentrated within certain states, such as Victoria, which highlights some of the problems that the Australian Government is having in managing states within different stages of the business cycle. As the mining boom winds down, employment levels are also falling within the commodity dependant northern regions. This poses a challenge to fiscal and monetary policy as they seek to balance a two speed economy.

However, it’s certainly not all bad news for the Aussie economy despite the seemingly poor unemployment result. Specifically, most of the pressure for the hike comes not from structural unemployment but rather a rise in the participation rate as more enter the workforce seeking employment. Additionally, there has been an increase in the overall level of full-time, over part-time employment, which is also encouraging.

Regardless, there still remains plenty of spare capacity within the economy which will need to be ironed out in the near future and the outlook for the labour market remains uncertain. This is especially the case given that the recent trend of 2014-2015 of employment gains appears to have definitely been broken. In the medium term this could complicate both economic growth and inflation prospects.

Ultimately, the uptick in the unemployment rate isn’t yet signalling a problem for the Australian economy, rather a slowing of growth and a rising participation rate which was relatively evident in the final quarter of 2016. Regardless, the rate still remains within an acceptable historical level so we are not yet at the point of declaring a deteriorating labour market but it certainly bears watching for any further fragility.