Investing.com’s stocks of the week

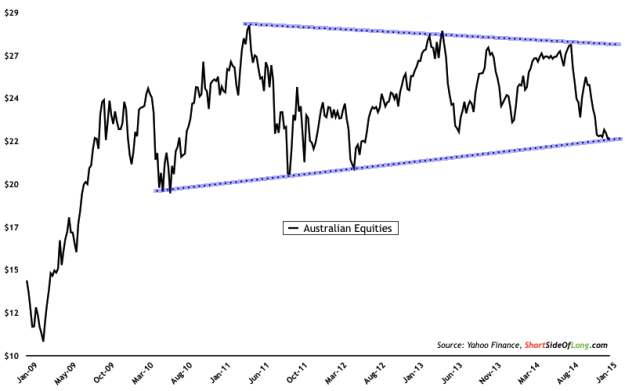

Chart 1: Aussie stocks have dropped 20% from September 2014 highs!

Australian equities, when priced in US dollars, have not performed all that well in recent years. All major fundamental aspects that were tailwinds and made Aussie stocks outperform during 2000s, have now become headwinds. Commodity prices have declined since 2011 and the strong currency has lost almost 25% in recent quarters. Technically, the price has been consolidating since 2009 (refer to Chart 1), similar to other emerging markets such as South Korea. This signals that the economy isn't booming, but at the same time it isn't in a recession either.

Traders and investors looking for a potential entry point, should now start paying attention. Having recently dropped 20% from intra day highs on 2nd of September all the way down to mid December lows, Australian equities (via iShares MSCI Australia Index (ARCA:EWA)) now look rather interesting. They are oversold, sentiment very negative and price sits on a major support level. Sentiment is actually so negative (refer to Chart 2), that previous readings such as these have marked an intermediate low. The same can be said about Australian Consumer Confidence too!

Chart 2: Investor sentiment is incredibly negative on the lucky country

Source: SentimenTrader (edited by Short Side of Long)

Having said that, it is difficult to say whether or not the index will bounce from the current support line. Certain traders could take this chance by executing the trade, with a tight stop loss below the support indicated in Chart 1. One of the main issues for Australian stocks, when we priced in US dollars, is the fact that the index tends to suffer as the local currency goes down. From a contrary perspective, the Australian dollar is now also incredibly oversold and seems to be in a final capitulation phase... dropping straight down (refer to Chart 3). If the currency shows signs of recovery, maybe the index itself could rebound too!

Chart 3: AUD is incredibly oversold and most likely in final capitulation