Australian Employment Data Release – How Should You Trade The AUD?

The Australian unemployment rate and related statistics for December are scheduled for release tomorrow (Thursday 15th) at 00:30 GMT. Employment data is a key input into the Reserve Bank of Australia’s monthly deliberations on interest rates and is widely seen as a driver of AUD exchange rates around the release date.

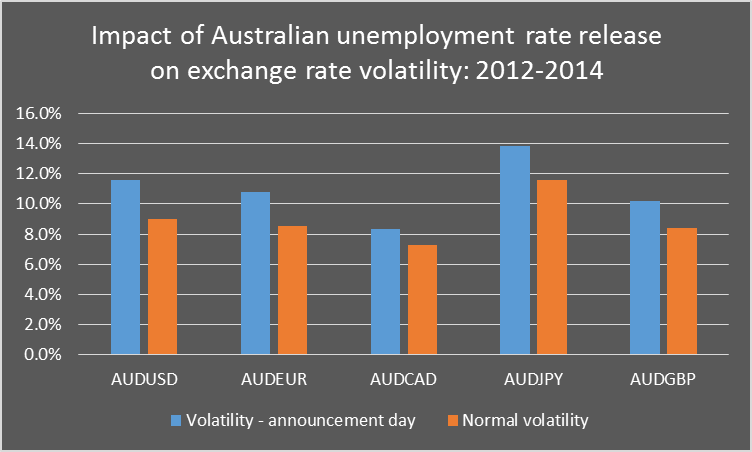

To gauge the announcement impact we looked back over the last three years at the movements in the AUD between close of trading the day prior to the announcement, and announcement date.

The volatility showed a significant increase (around 20%) over the normal level on announcement date –

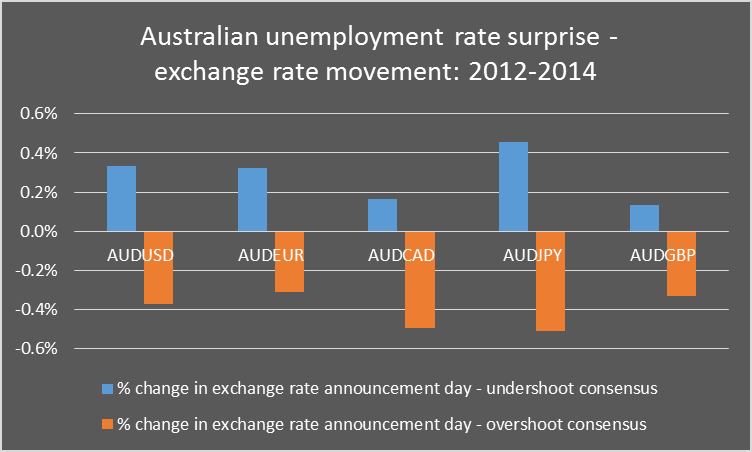

There is also a clear and expected relationship between surprises and the exchange rate movement (the AUD strengthens when the announced unemployment rate undershoots consensus and weakens when the converse applies).

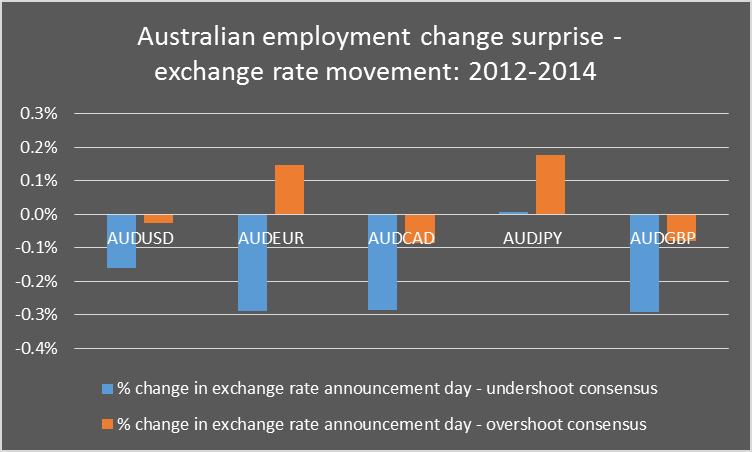

The relationship between surprises with regard to the Employment Change statistic and the AUD is less clear, so the unemployment rate is the one to watch –

Our statistical analysis of consensus vs actual employment rate data over the last eight years suggests a slight bias towards undershoot of the 6.3% consensus estimate.

How to trade the AUD in the short term?

The answer is never clear cut, but the following observations based on our analysis indicate some of the considerations.

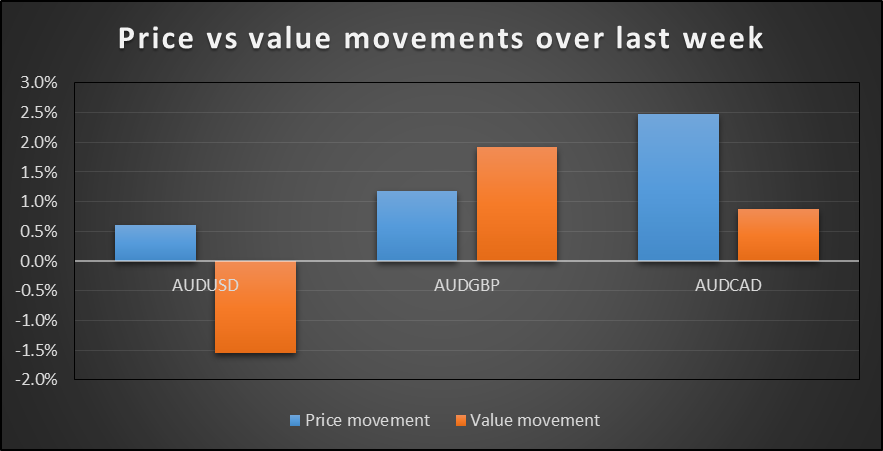

The graph below shows that the AUD has strengthened against US Dollar Index over a week when the fair value moved in the opposite direction and overshot the fair value increase against CAD. Both pairs are therefore short term sells.

As shown in a previous graph, whilst the upside and downside from the announcement is roughly equal for AUDUSD, there is more downside from an announcement overshoot than upside from an undershoot, for AUDCAD. That would tend to move the balance further in favour of selling AUDCAD.

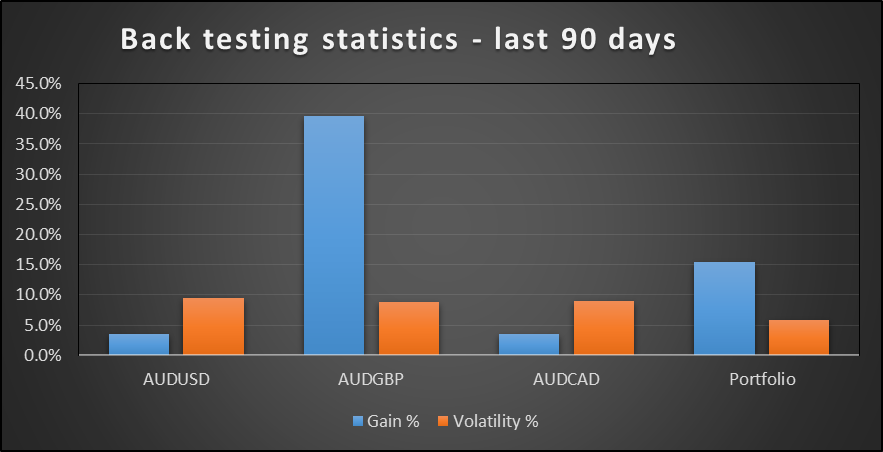

For AUD/GBP, price decline has overshot the value decline to give a buy signal on the pair. Moving the odds further towards buying the pair is the backtest performance from following our fair value movement indicator (graphed below), which has been quite favorable for AUD/GBP. However the greater downside from an overshoot than upside from an undershootsuggests that conviction is needed in a strong employment result.

Portfolio approach – suggested to mitigate risk

As can be seen from the graph below, volatility is lowered considerably by trading a portfolio of the three pairs when following our fair value movement indicator. This approach also mitigates the backtest repeatability risk and the employment data announcement risk (one buy vs two sells rather than all one direction on AUD).