In the last edition of “Forex Critical” I claimed that the Australian is not likely to maintain its current blistering pace of gains. Just three days later, the stubbornly persistent rally of the Australian dollar (Guggenheim CurrencyShares Australian Dollar (NYSE:FXA)) may already be grinding to a halt.

The Australian Bureau of Statistics (ABS) released its inflation data for March, 2016. I would not have considered the report particularly remarkable without the out-sized reaction in currency markets.

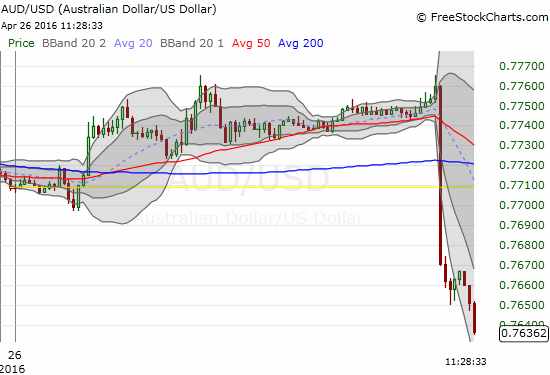

The Australian dollar (FXA) plunges following the March inflation report

The Australian dollar may have finally peaked thanks to a disappointing inflation report.

Source: FreeStockCharts.com

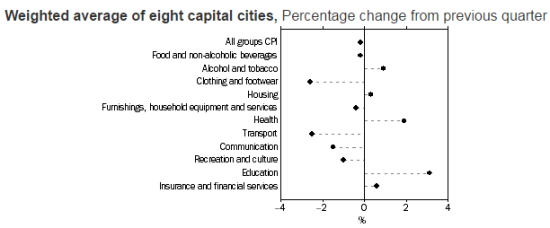

Inflation in Australia actually fell 0.2% quarter-over-quarter in March. The December quarter delivered a 0.4% quarterly rise. March moved the annual trailing inflation rate from 1.7% to 1.3%, now well off the Reserve Bank of Australia’s 2% target.

The leading drag on inflation came from fuel prices: the 10% price drop in automotive fuel, the third quarterly drop, drove transportation prices down 2.5%. Much more worrisome perhaps was the 1% drop for recreation and culture which includes domestic and international holiday travel and accommodation. The report did not mention a driver, but I assume this weak pricing implies weakened demand in this sector. Perhaps the strong Australian dollar had something to do with the performance: Australians choosing to travel abroad to take advantage of their stronger currency and international visitors choosing to stay away from the relatively high prices.

Clothing and footwear and transport dragged on inflation while education costs soared.

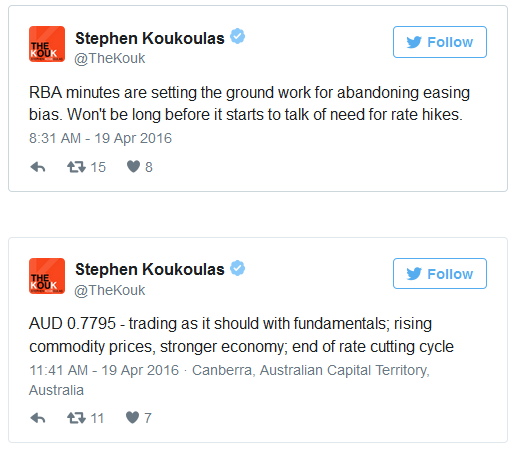

The rise in the Australian dollar and commodities had at least one prominent economist starting to dream about rate hikes in the near future.

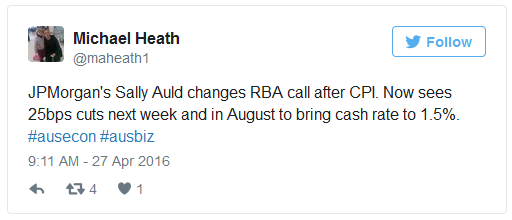

These calls are clearly VERY premature, especially since the RBA policy statements continue to signal that the central bank stands ready to cut rates if necessary. The RBA has not even come close to hinting about the potential for rate hikes. These inflation numbers could be the trigger for at least more direct dovish talk from the RBA. Indeed, the thinking is already turning as quickly as the Australian dollar…

Be careful out there!

Full disclosure: net short the Australian dollar