The September Australian Dollar fell on Monday as traders shed risky assets in a typical “risk-off” trading session. Concerns about Europe once again controlled the trade. Investors initially began selling early in the session after Spain formally requested bailout money for its ailing banking system. As global equity market began to fall, the Australian Dollar accelerated to the downside.

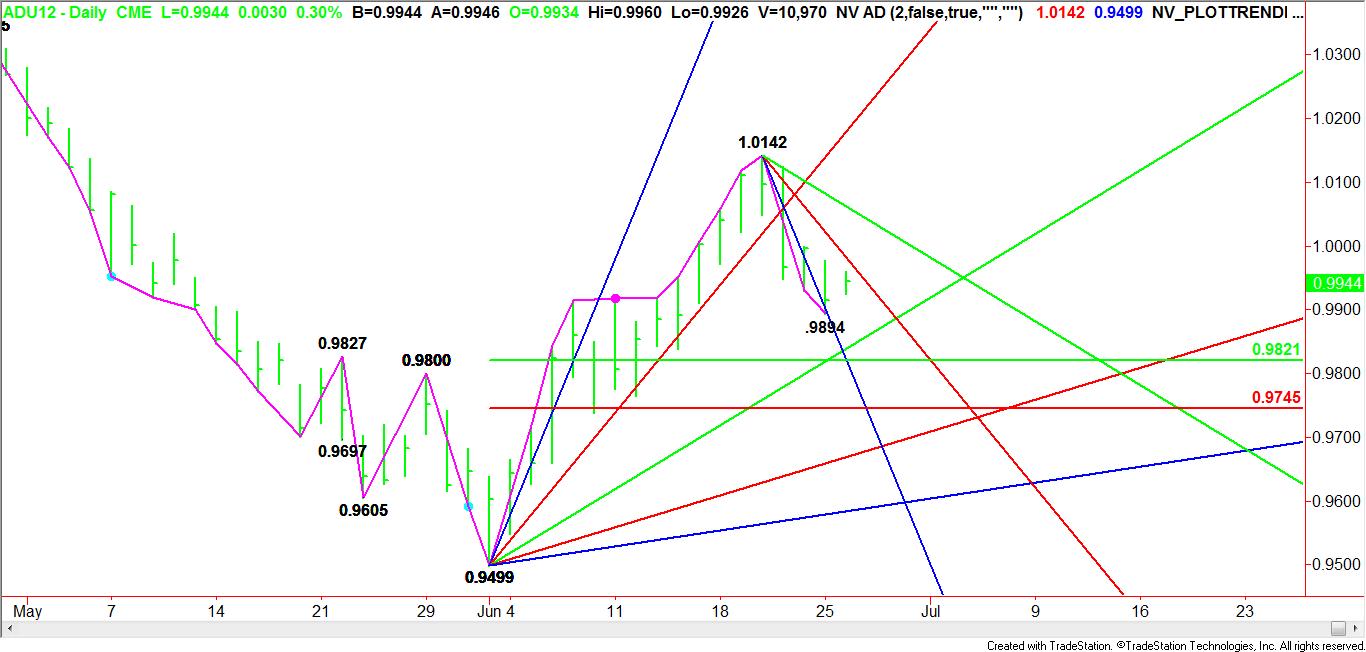

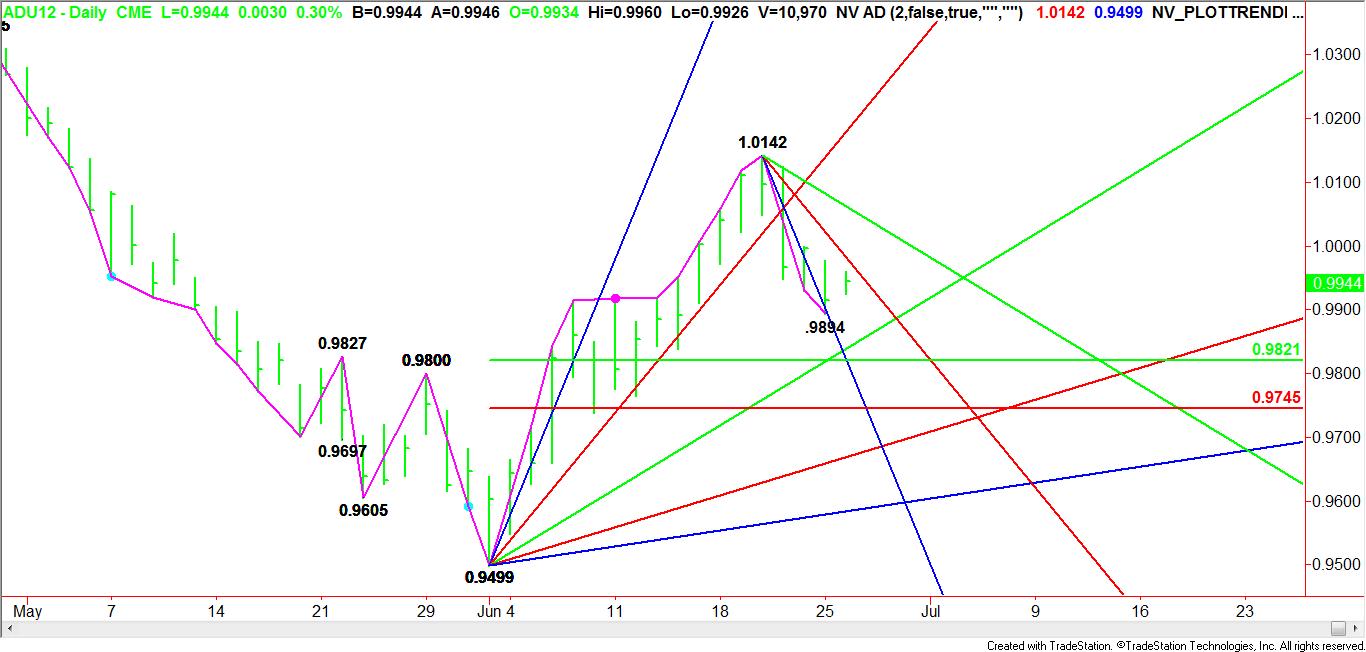

Technically, the first downside target was the uptrending Gann angle from the .9499 bottom at .9839 today. This is well below Monday’s low at .9894. Based on the main range of .9499 to 1.0142, the second downside target is a retracement zone at .9821 to .9745.

The lack of follow-through to the downside overnight suggests that the September Australian Dollar may be poised for a short-term rally. Given the near-term range of 1.0142 to .9894, the currency may retrace into the 50% to 61.8% retracement zone at 1.0018 to 1.0047. Standing in the way of this retracement zone is a downtrending Gann angle at .9839.

Although investors may be skeptical about the outcome of the European Summit which begins on Thursday, it appears they are lightening up their short positions ahead of the meeting just in case a workable plan is proposed. This is helping to support the global equity markets as well as other higher risk assets. With the Spanish bailout request out of the way and the European Summit scheduled to start later in the week, it looks as if the Aussie dollar is likely to trade rangebound for at least the next 2 to 3 days.

Technically, the first downside target was the uptrending Gann angle from the .9499 bottom at .9839 today. This is well below Monday’s low at .9894. Based on the main range of .9499 to 1.0142, the second downside target is a retracement zone at .9821 to .9745.

The lack of follow-through to the downside overnight suggests that the September Australian Dollar may be poised for a short-term rally. Given the near-term range of 1.0142 to .9894, the currency may retrace into the 50% to 61.8% retracement zone at 1.0018 to 1.0047. Standing in the way of this retracement zone is a downtrending Gann angle at .9839.

Although investors may be skeptical about the outcome of the European Summit which begins on Thursday, it appears they are lightening up their short positions ahead of the meeting just in case a workable plan is proposed. This is helping to support the global equity markets as well as other higher risk assets. With the Spanish bailout request out of the way and the European Summit scheduled to start later in the week, it looks as if the Aussie dollar is likely to trade rangebound for at least the next 2 to 3 days.