-

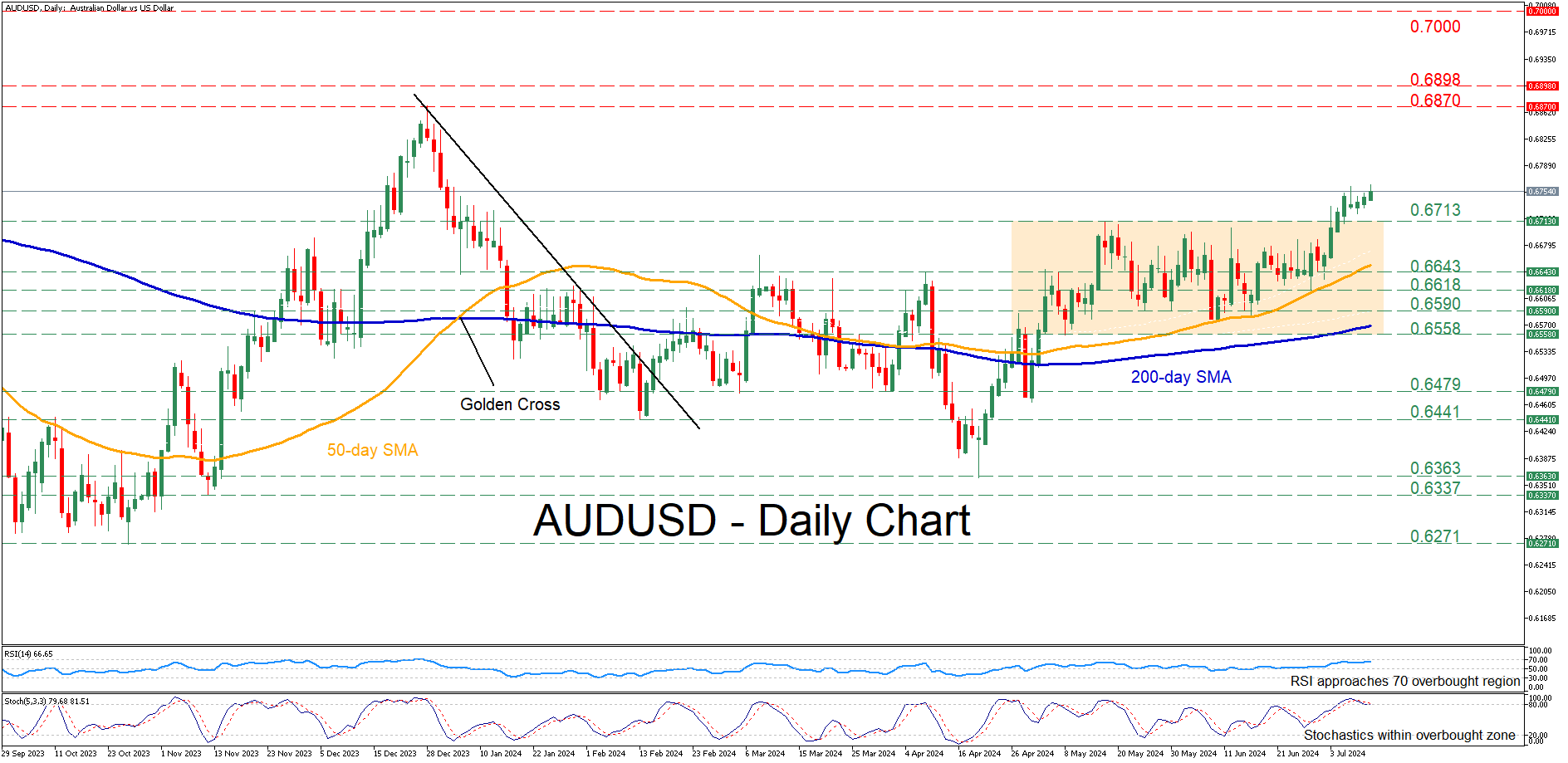

AUD/USD breaks decisively above sideways pattern

-

The price jumps to its highest since January 2024

-

Oscillators are flagging overbought conditions

Australian dollar had been trading sideways for more than two months, unable to adopt a clear directional impetus. However, in the last few sessions, the bulls have managed to propel the pair above that rangebound structure, sending it to a six-month high on Thursday.

If the pair marches towards fresh highs, there is no prominent resistance until the December 2023 peak of 0.6870. Failing to halt there, the pair may advance towards the double-top region of 0.6898, registered last summer. Higher, the 0.7000 psychological mark might come under examination.

On the flipside, should the pair reverse lower, immediate support could be found at the May resistance of 0.6713. A violation of that hurdle could send the price back within its neutral structure, where the April-May resistance of 0.6643 could now serve as support. Further declines could then come to a halt at the June support of 0.6618.

In brief, AUD has gained momentum after the break above its neutral structure, storming to a fresh six-month peak. However, the risk of an impending pullback is evident, as both the RSI and stochastics are warning of an overstretched advance.