Australian dollar weakens after the Reserve bank of Australia held cash rate unchanged at 1.50% as widely expected and maintained a neutral stance. RBA reiterated in the statement that "taking account of the available information, the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time." The statement itself is largely unchanged from the prior one.

Nonetheless, RBA sounded more concerned on employment as it noted that "some indicators of conditions in the labour market have softened recently." Meanwhile, RBA also said that "by reinforcing strong lending standards, the recently announced supervisory measures should help address the risks associated with high and rising levels of indebtedness. " And the central bank welcomed the "reduced reliance" on interest-housing loans as a positive development.

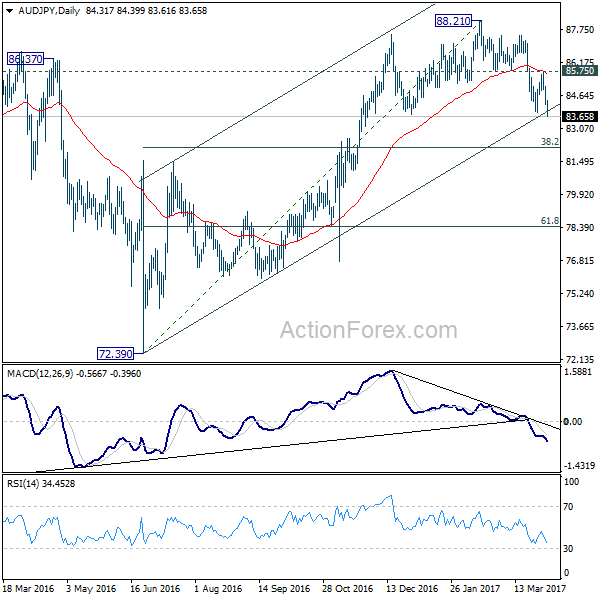

AUD/USD and AUD/JPY resumes near term fall

Technically, AUD/USD's break of 0.7586 today indicates that fall from 0.7748 has resumed for 0.7490 key near term support. Decisive break there will confirm short term trend reversal. AUD/JPY also dives through last week's low at 83.81. And it confirms resumption of whole decline from 88.21. Prior rejection from 55 day EMA is seen as a sign of near term bearishness. As mentioned in our weekly report, we'd expect AUD/JPY to target 38.2% retracement of 72.39 to 88.21 at 82.16.

Yen jumps after Russia terrorist attack...

Elsewhere, Yen surges broadly on risk aversion as terrorist attack at St Petersburg, Russia weighed on sentiment,According to three state-owned Russian media, at least eleven people were killed in the St Petersburg metro explosion. President Vladimir Putin suggested it would be considered as a terrorist attack "first of all". As noted in his statement released after the incident, "the causes of this event have not been determined yet, so it's too early to talk about [possible causes]… The investigation will show. Certainly, we will consider all variants, common, criminal, first of all, of a terrorist nature".

... and falling US treasury yields

Comments from New York Fed President William Dudley weighed down US treasury yields. At an interview with Bloomberg TV, Dudley indicated that the Fed is not in a rush to raise the policy rate. As he noted, "a couple more hikes this year seems reasonable… It wouldn't surprise me if sometime later this year or sometime in 2018, should the economy perform in line with our expectations, that we'll start to gradually let securities mature rather than reinvesting them,…we might actually decide at the same time to take a little pause in terms of raising short-term interest rates". 10 year yield dropped through last week's low at 2.348 to as low as 2.332 before closing at 2.350.

On the data front...

Australia trade surplus widened to AUD 3.57b in February. Japan monetary base rose 20.3% yoy in March. UK will release construction PMI in European session while Eurozone will release retail sales. Canada will released trade balance. US will release trade balance and factory orders.