The Australian Dollar has been going through the rungs as of late, as economic data disappoints the markets over and over again. This shouldn’t come as a surprise to many peoplethough, as Australia has been having it tough lately as the economy reels from a downturn in commodity prices and a slowdown in China; which go hand in hand really.Either way, the market is looking a little more darker (one might think), but when we look at the data,it’s not entirely dismal news.

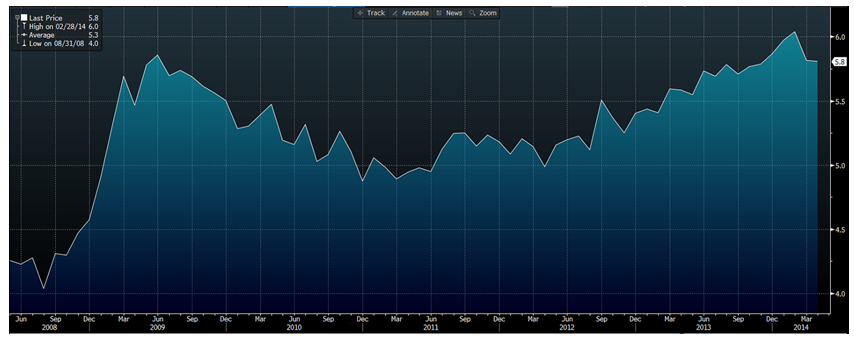

The start of the week saw building approvals m/m come in at a disappointing -3.5%, however, this was certainly better than last month’s -5.0% - so there’s some improvement in the numbers. The trade balance showed additional disappointed coming in at $731M, which was worse than the previous $1200M and retail sales also disappointed only up 0.1% compared to last month’s 0.2%.Unmployment though remained flat at 5.8% as of this morning, which is positive news when it was forecast to get worse.

Source: Bloomberg (Australia Unemployment %)

Okay, so maybe things are getting a little worse than expected, but it's certainly not the end of the world for the Australian dollar, especially when we consider the AUD/USD cross!

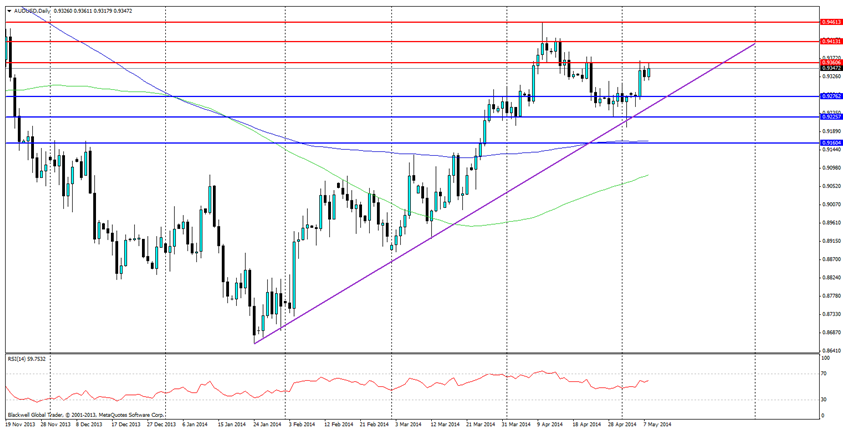

Source: Blackwell Trader (AUD/USD, D1)

The Australian dollar has been doing extremely well against the USD for a number of reasons that have surprised many analysts and the Reserve Bank of Australia (RBA). Firstly, the government is looking to return to surplus as soon as possible. Secondly, the mining sector is still generating profits and looking at efficiency, even during a downturn. Thirdly, the RBA has stopped trying to talk down the currency – this has to be the largest effect in my opinion.

While Reserve Banks like to strong jaw currencies, the reality is that if you don’t back it up with action, it's unlikely to do much in the long term, and when the RBA spoke and didn’t act, well you can clearly see the results on the chart above.

The other main impact can be seen quite easily on another chart.

Source: Blackwell Trader (Dollar Index, D1)

The USD has been trending aggressively downwards for some time and recently hit a new low. While many would argue that the dollar index is a basket of currencies (which it is), it still represents the dollar as a whole,as well as general global direction. This in turn has helped the Aussie dollar climb out of the rut that it was in after the markets took to it heavily.

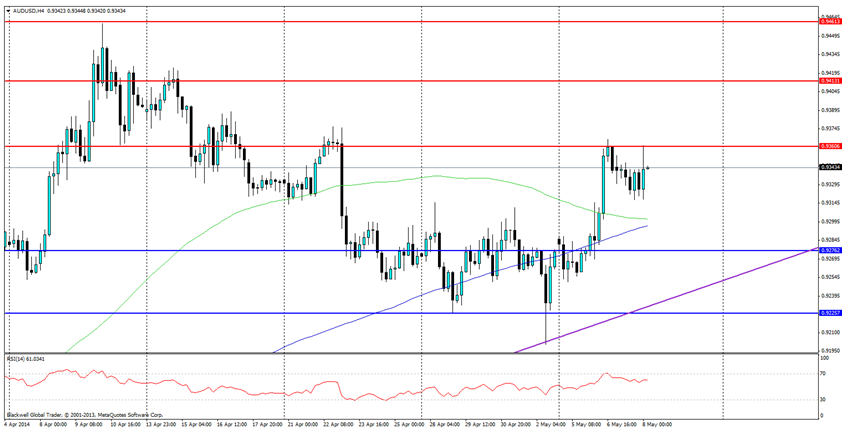

Source: Blackwell Trader (AUD/USD, H4)

Trading the AUD/USD, it’s important to note key resistance levels. A breakout above the 0.9360 level would point to further bullish movements; especially after today’s positive unemployment result. On the other hand, a heavy push on the trend line on the daily chart would signal the bears are back in town and we should be very careful. Support levels are semi transparent in the current chart, and it's more than likely they will be broken by markets looking to touch the trend line and push on stops.

Either way, the AUD/USD is looking very attractive for traders, and I expect to see further moves higher. My justification is simple, the economy is in bad shape but it will improve in the medium term, and it does not have the pressure of the RBA trying to hold it down. Furthermore, the trending market is still very much strong and active when it comes to the Aussie dollar, so don’t expect to see it stop any time soon. If anything, I would expect to see it push the 95 cent mark in the coming months, unless there was any shocking developments to derail that.