When you think of Australia it brings to mind sunshine, Kangaroos, Koala Bears, the Gold Coast and Great Barrier Reef, the Harbour Bridge and the Sydney Opera House. All are great ambassadors for Australia. But despite all these the economic world looks to Australia as a Commodity Country. That is to say that its economic cycle and currency price is highly driven by commodity prices. Don’t believe it? Take a look.

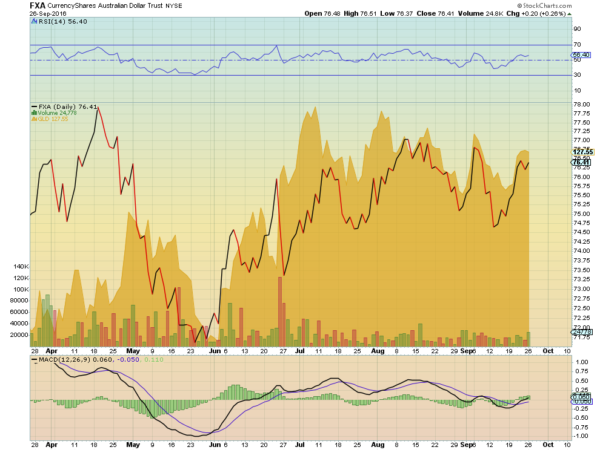

The chart above shows the price of ETF for the Australian dollar, which tracks the foreign exchange rate, as the line. The area chart behind is the price of the Gold ETF (NYSE:GLD). The two do not always move together. In fact you can see on the left side of the chart how the Aussie dollar started to drop well before the price of gold started to move lower.

But as the price of gold turned lower, the two charts started to grow closer in their phase. Gold was behind by about a week at the end of May. By mid July the two were only a couple of days out of phase. By mid August the two were completely in sync. Since then they have moved in step for over a month. This is how you define a commodity currency.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.